Corporate Health Insurance

As a business owner, the responsibility of providing group medical insurance to your employees can be a challenging and critical task. In this comprehensive guide, we’ll navigate the intricate landscape of selecting the best group medical insurance for corporates, or corporate health insurance. We’ll dive into the essentials of group medical insurance including factors to consider, various types of insurance plans available, and provide insights on how to effectively compare insurance premiums. By the end of this guide, you’ll be equipped with the knowledge and confidence to make an informed decision that benefits both your business and your employees.

In the ever-evolving landscape of employee benefits, corporate health insurance has emerged as one of the most vital perks offered by companies today. It’s more than just a perk; it’s a key component of employee well-being and satisfaction. As businesses strive to attract and retain top talent, providing comprehensive health coverage has become a necessity rather than a luxury.

At i-Brokers, we understand the importance of finding reliable and affordable group medical coverage that aligns with your budget and the needs of your employees. Our mission is to simplify the process and help you make the right choice. Click here to get a quote for your group medical insurance.

Corporate Group Health Insurance

Corporate Group Health Insurance

What is a Group (or Corporate) Health Insurance Plan?

Corporate health insurance, also known as group health insurance, is a policy provided by employers to their employees and, in many cases, their families. Unlike individual health insurance plans, corporate plans offer coverage to a group of people under a single policy, usually at a reduced cost due to the collective bargaining power of the group. This approach to insurance is advantageous for both employers and employees, offering several benefits that make it a preferred option for corporate environments. It is one of the most common ways for employers to offer healthcare benefits to their staff.

Here are some key characteristics of a group insurance plan:

- Coverage for a Group: As the name suggests, group health insurance provides coverage to a defined group of individuals who share a common affiliation. This group can be employees of a company, members of an association, or any other organized collective.

- Employer-Sponsored: In many cases, group health insurance is offered as an employee benefit by employers. The employer selects and purchases the insurance policy, and employees are often required to contribute to the cost through payroll deductions. This is usually how small company health plans work.

- Shared (potentially, lower) Premiums: Both the employer and employees typically share the cost of the insurance premiums. Employers usually cover a portion of the premium, while employees pay the remaining amount. This cost-sharing arrangement makes it more affordable for individuals. However, this usually depends on the organization and country you work in. Furthermore, because the risk is distributed across a large group, premiums are generally lower compared to individual health insurance plans. Employers often cover a significant portion of these premiums, further reducing the cost for employees.

- No Individual Underwriting: Unlike individual health insurance plans, group health insurance usually does not require individual underwriting or medical examinations for each member. This means that employees or members are generally accepted into the plan without regard to their individual health conditions. This is why organizations consider i-Brokers as part of their group medical insurance solutions.

- Uniform Benefits: Group health insurance plans offer a standardized set of benefits to all members of the group. These benefits may include coverage for doctor’s visits, hospital stays, prescription drugs, preventive care, and more. The specific details of coverage can vary from one plan to another.

- Negotiated Rates: Insurance companies often negotiate rates with healthcare providers, including doctors and hospitals, on behalf of the group. This can result in significant cost savings for both the insured individuals and the employer. Contact us today to enquire about negotiable group rates on select plans.

- Risk Pooling: One of the primary benefits of Group health insurance is it relies on the principle of risk pooling. This means that the health risks and costs are spread across the entire group. Healthier individuals may subsidize the healthcare costs of those who require more medical care. Ultimately, all the risk within the organization is pooled together. The healthier your workforce, the lower premiums you pay!

- Tax Benefits: In many countries, such as Thailand or Hong Kong, group health insurance premiums paid by employers are often tax-deductible as a business expense. This can provide financial incentives for employers to offer coverage to their employees.

As you can see, group health insurance is a valuable tool for businesses and corporate organizations to attract and retain talent, promote employee well-being, and ensure that their members have access to essential healthcare services. It provides a sense of security and peace of mind, both for employers who want to take care of their employees and for individuals who benefit from the collective power of group coverage. Companies that provide health insurance tend to experience lower turnover rates and higher employee satisfaction. Health insurance can be a key differentiator in job offers, giving companies a competitive edge when recruiting talent.

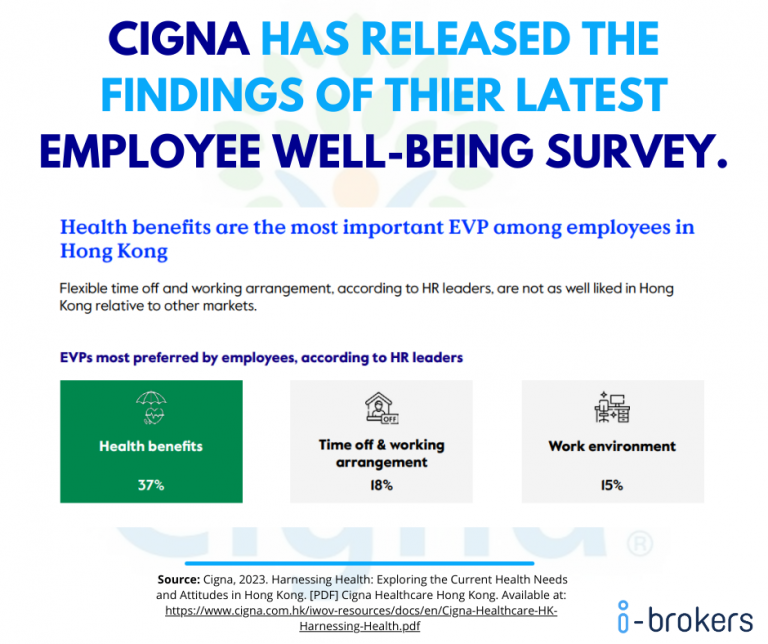

Cigna recently released the findings of their latest employee well-being survey. This was a survey of HR professionals in organizations across 5 key markets (Hong Kong, Singapore, US, UK, and UAE), exploring the impact of health and well-being benefits on workforces.

- 7 in 10 HR leaders surveyed perceive health insurance as a key factor in promoting employee wellness and longevity within the company.

- Health Benefits are the most important EVP (employee value proposition) among employees in Hong Kong, even more so than time off and work arrangement (22%), and career progression (20%).

👇For a customized quote, fill out this form and our trusted advisor will reach out to you. 👇

How Does Corporate Health Insurance Work?

A crucial aspect of choosing a group health policy is understanding how it works. Here’s a simplified breakdown:

1. Plan Selection:

- Employer Enrollment: In the initial stages, the business owner (employer) enquires about the healthcare needs of the employees and the budget constraints of the business. Following this, they usually work with an independent broker (like i-Brokers) to compare different insurance options available and select a group health insurance plan that fits their needs and budget constraints.

- Plan Options: Insurance Brokers typically offer a range of plan options, each with different levels of coverage and associated costs. The employer must decide which plan best suits the needs of their workforce.

2. Employee Contribution: Employees who opt for coverage usually contribute to the cost of their health insurance through regular payroll deductions. The employer usually contributes a majority of the premium, easing the financial burden on their staff.

3. Coverage and Benefits:

- Medical Services: Once enrolled, employees gain access to a wide range of medical services, depending on the terms of the selected group health insurance plan. These services usually include doctor’s visits, hospital stays, surgeries, specialist consultations, preventive care, and prescription drug coverage.

- Coverage Levels: The specific coverage levels and benefits vary from one plan to another. Employers may choose plans with different levels of deductibles, copayments, and out-of-pocket maximums to suit their budget and the preferences of their employees.

- Network Providers: Group health insurance plans usually have a network of healthcare providers, including doctors, hospitals, and clinics. Employees are encouraged to use in-network providers to maximize coverage and minimize out-of-pocket expenses.

4. Financial Responsibility:

- Deductibles: In most group plans, both the employer and employees share the cost of healthcare. Employees are often required to meet a deductible, which is a predetermined amount they must pay out of pocket before the insurance plan begins covering medical expenses.

- Copayments and Coinsurance: After meeting the deductible, employees may be responsible for copayments (fixed fees for specific services) and coinsurance (a percentage of the cost of services).

- Services Not Covered: There are also services and treatments that may not be fully covered by the insurance plan. These can include elective procedures, certain medications, or treatments deemed medically unnecessary.

5. Continued Management:

- Claims Processing: When employees receive medical care, they or the healthcare provider submit claims to the insurance company for reimbursement. The insurance company processes these claims and pays out benefits as outlined in the plan.

Read more about how to select the right group health insurance policy, or the impact of group medical insurance on employee retention, or 6 things to consider before group health policy renewals.

How to Get Corporate Health Insurance?

When it comes to obtaining a group health insurance policy for your business, you have two primary options:

1. Do it Yourself: Business owners can make enquiries from different insurance providers companies but might be time-consuming and difficult to compare prices, services, and plans that meet their specific needs.

2. Work with an Insurance Broker: Insurance brokers possess in-depth knowledge of health insurance plans, along with familiarity with compliance and legal requirements. Ensure you collaborate with an independent broker who can tailor plans according to your unique requirements and budget. Click here to speak with an expert group health advisor.

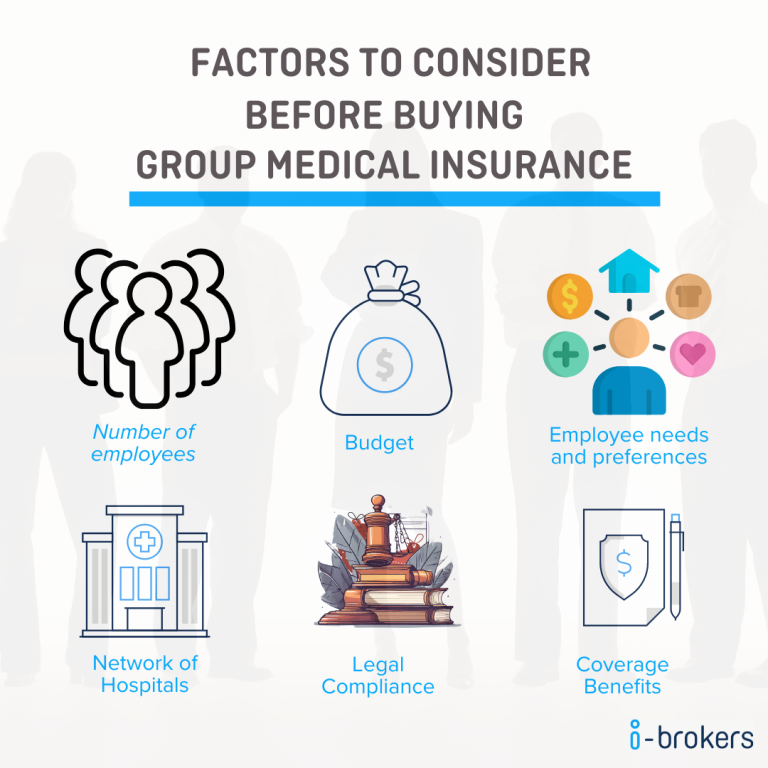

Factors to Consider When Choosing Group Medical Insurance

When evaluating group medical insurance options for your business, several factors warrant careful consideration:

- Number of Employees: The size of your workforce plays a significant role in determining the type of group insurance plan you can qualify for. It’s essential to understand the minimum employee threshold required for eligibility. Normally, this is around 10 people, but it varies depending on the insurance provider.

- Budget: Your budget is a key driver in selecting the right plan. Consider both your financial capabilities and the affordability of the plan for your employees.

- Provider Network: The availability of healthcare providers within the plan’s network is crucial. Ensure that the plan you choose includes providers accessible to your employees.

- Employee Needs and Preferences: Assess the unique healthcare needs and preferences of your employees. Different plans offer varying coverage and benefits, so it’s vital to align these with your employees’ expectations. Consider factors such as age, gender, marital status, and family size, as these can influence the type of coverage your employees will need.

- For example: Young, Single Employees: May prefer plans with lower premiums and higher deductibles, as they typically have fewer healthcare needs. Employees with Families: May prioritize comprehensive coverage that includes dependents, maternity care, and pediatric services. Older Employees: May require plans that offer robust coverage for chronic conditions, prescription medications, and preventive care.

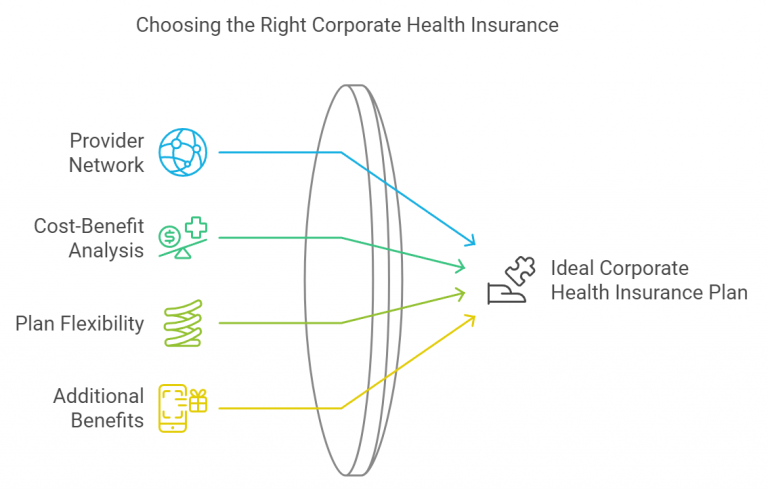

Tips for Choosing the Best Group Medical Insurance Plan for Corporates

- Consider the Provider Network: Ensure that the plan’s network includes healthcare providers conveniently accessible to your employees.

- Compare Costs and Benefits: Balance the cost of premiums, deductibles, and out-of-pocket expenses with the coverage and benefits offered. You can compare group medical insurance quotes here.

- Review the Plan’s Flexibility: Opt for plans that provide flexibility to accommodate the diverse needs of your employees.

- Check for Additional Benefits: Some plans offer additional perks such as wellness programs or telehealth services. Explore these options to enhance employee satisfaction.

Why Choose i-Brokers for your Corporate Health Insurance Plan

When it comes to selecting a corporate health insurance provider, the choice you make can have a lasting impact on both your employees’ well-being and your company’s financial health. With so many options available, it’s essential to partner with a broker that not only has the know-how of the provider networks but also delivers exceptional service and flexibility.

At i-Brokers, we’re not just insurance experts—we’re your strategic partners. We understand that each business has unique needs, and we’re committed to finding a plan that aligns perfectly with your goals. Our mission? To secure you a corporate health insurance plan that offers:

- Comprehensive coverage that leaves no stone unturned

- Affordability that keeps your bottom line healthy

- Peace of mind for you and your valued employees

Whether you’re a small business or a large multinational corporation, we offer plans that can scale with your employee needs and requirements. By partnering with i-Brokers, you gain access to a wealth of knowledge and experience that can help you navigate the often-complex world of corporate health insurance with confidence.

Our goal is to make insurance transparent. Navigate to the Group Medical Insurance page and input your details and requirements. A trusted advisor will get back with options available to you. Alternatively, speak to one of our insurance experts to get a customized quote on your group plan.

Best Corporate Health Insurance Plans in Hong Kong

The multitude of options available is exhilarating. We understand that the needs of business owners are distinct. Our goal at i-Brokers is to help you find the best group health insurance plan that provides comprehensive coverage, affordability, and peace of mind for both you and your employees. The best corporate health insurer depends on each country. For this article, we’ll use Hong Kong as an example. After extensive research and analysis, we’ve identified the top 3 corporate health insurance providers that stand out in Hong Kong’s competitive market. These insurers have consistently demonstrated excellence in service, coverage, and value. Find our guide to group medical insurance in Hong Kong here.

Here’s a list of the Top 3 Best Corporate Health Insurance Providers in Hong Kong:

AXA

- Known for: Comprehensive and flexible corporate solutions

- Standout features: Wide range of customizable plans

- Extensive local and international medical network

- Innovative digital health services

- Wellness programs to promote employee health

- Best for: Companies seeking flexible plans with strong digital integration

- AXA’s Health and Productivity Solutions, integrating health management with insurance coverage

MSIG

- Known for: Tailored insurance solutions for businesses of all sizes

- Standout feature: Flexible plan designs with optional benefits

- Comprehensive medical coverage including hospitalization and outpatient care

- Dental and optical coverage options

- Maternity benefits available

- Best for: Companies looking for customizable plans with a balance of coverage and cost. MSIG’s Business Advantage Plus plan, offering scalable coverage for SMEs to large corporations

BUPA

- Known for: High-quality healthcare services and coverage.

- Standout features: Comprehensive wellness programs and digital health services

- Wide range of preventive care services

- Mental health support including counseling services

- 24/7 virtual GP consultations

- Best for: Businesses prioritizing holistic health and wellness solutions.

- Bupa’s digital health app for easy claims and health management

Frequently Asked Questions About Corporate Health Insurance

- What is the Minimum Number of Employees Required to Qualify for Group Medical Insurance? If you have between 1 – 50 employees, this qualifies your company for small business group coverage. If you have over 50 employees, your company will qualify for large group coverage. However, this usually varies depending on your location and your insurer. It’s advisable to consult with an insurance broker or expert to determine your specific requirements.

- How Much Does Group Medical Insurance Cost for Businesses? The cost of group medical insurance for businesses can vary significantly based on several factors, including the location of the business, the size of the workforce, the selected insurance provider, and the level of coverage. On average, employers often share the cost with employees, with employers typically covering a portion of the premium. The actual cost can range from a few hundred dollars per month per employee to several thousand dollars, depending on these variables.

- When does a business have to offer health insurance? In general, businesses with 50 or more full-time equivalent employees must offer affordable health insurance to their full-time employees or face potential penalties. However, businesses with fewer than 50 employees are generally not required to provide health insurance, although they may choose to do so as a benefit to attract and retain talent. However, this usually depends on the regulations in your country.

- How much does group health insurance cost? The cost of group health insurance for businesses can vary widely. It depends on factors such as location, the number of employees, the selected insurance plan, and the level of coverage. On average, businesses can expect to pay several hundred dollars per month per employee for group health insurance. However, this cost can be higher or lower depending on the specific circumstances and choices made by the employer and employees

Conclusion

In conclusion, selecting the best corporate (or group) medical insurance policy requires careful consideration of various factors. It’s essential to align the chosen plan with your budget, the needs of your employees, and the legal requirements of your jurisdiction. The key takeaways from this article are:

1. Customization is Critical: Tailoring corporate health insurance to align with your company’s needs is essential for maximizing its value.

2. Cost-Sharing Benefits: Employers typically share the cost of premiums with employees, making group plans more affordable compared to individual health insurance

3. Risk Pooling Advantage: Group health insurance spreads health risks across all members, which can lead to lower premiums and better access to care.

At i-Brokers, we are here to help you navigate this process and find the most suitable group health insurance solutions for your business. Ultimately, the choice you make in group medical insurance will not only provide essential healthcare coverage but also contribute to the overall well-being and satisfaction of your employees. It’s an investment in your workforce and a testament to your commitment to their health and security.