AXA

Experience Top-Tier Health Insurance Solutions from one of the premier insurance providers in the world, AXA! Discover AXA health insurance plans that provide robust in-patient and out-patient coverage along with an easy claims process for hassle-free healthcare.

About AXA

AXA Global Healthcare is widely used throughout the world and is among the most popular in Hong Kong, Europe and the Middle East. They are a dedicated supplier of health insurance based in the UK and with servicing offices throughout the world. As a global leader in insurance and asset management, AXA serves over 105 million clients in 54 countries. AXA offers a comprehensive range of products and services, including life, health, and property insurance, as well as savings and investment solutions.

AXA are also widely considered to be the world’s largest insurance brand.

AXA Global Healthcare is an award-winning insurer specializing in healthcare for the globally mobile and expat. AXA provide a range of services to assist come claim time. This includes 24/7 Health at Hand telephone helpline manned by healthcare professionals, telephone interpretation so any time of day or night, members can call and arrange for a skilled interpreter to come on the line and help.

The reach of the AXA network means that they are able to provide global coverage either by themselves or through their local partners. Working with 13 partners around the world to give their clients the choice of global, regional or local products AXA clients can benefit from access to over 12,000 hospitals around the globe. With an AXA international health plan they can settle bills directly and can even arrange to pay that hospital direct when they call to confirm their treatment is covered.

AXA provide a very unique security hotline with intelligence on more than 180 countries and 900 cities. This gives you the aid and information you need should you ever need to visit any dangerous locations. Personal medical case management means your own independent case manager will engage with experts from around the world to create and manage a personal care plan for AXA members and provide guidance to ensure they get the most appropriate treatment possible.

AXA Health Insurance Plans

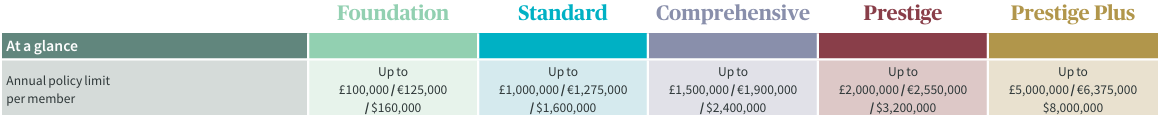

AXA Thailand offers a spectrum of health insurance plans, each designed to cater to varying levels of coverage and financial needs. Here is an overview of the plans:

Foundation Plan

- Annual Policy Limit: Up to £100,000 / €125,000 / $160,000

- Coverage: Basic coverage suitable for individuals seeking essential in-patient and out-patient care. It includes hospitalization, surgery, and access to a virtual doctor service.

Standard Plan

- Annual Policy Limit: Up to £1,000,000 / €1,275,000 / $1,600,000

- Coverage: Enhanced coverage with higher limits, including comprehensive in-patient and out-patient treatments, diagnostic services, and evacuation and repatriation benefits.

Comprehensive Plan

- Annual Policy Limit: Up to £1,500,000 / €1,900,000 / $2,400,000

- Coverage: Mid-range plan offering extensive in-patient, day-patient, and out-patient treatments. Additional benefits include consultations, prescribed drugs, and complementary therapies such as physiotherapy and vaccinations.

Prestige Plan

- Annual Policy Limit: Up to £2,000,000 / €2,550,000 / $3,200,000

- Coverage: High-level coverage with extensive benefits for in-patient, out-patient, and day-patient treatments. This plan includes advanced cancer treatment options, psychiatric care, and comprehensive support services.

Prestige Plus Plan

- Annual Policy Limit: Up to £5,000,000 / €6,375,000 / $8,000,000

- Coverage: The most comprehensive plan offered, providing full coverage for major medical expenses. Benefits include in-patient and out-patient care, advanced diagnostic services, specialized treatments, and substantial support for chronic conditions and rehabilitation

AXA Table of Benefits

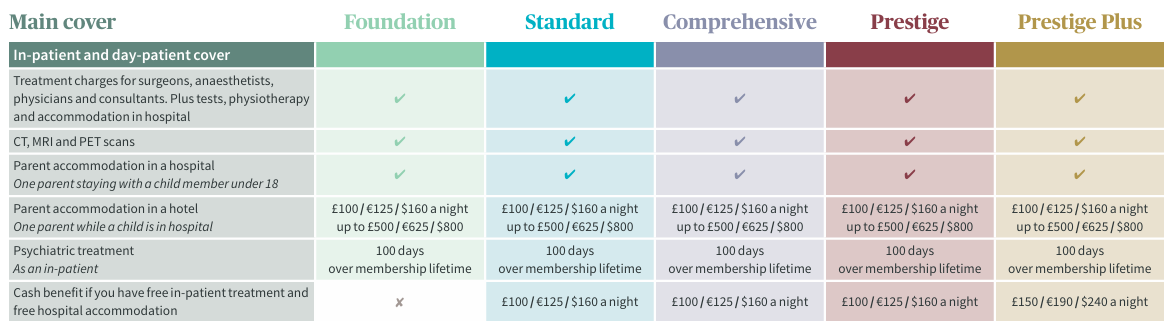

In-Patient Coverage

AXA Thailand provides extensive in-patient coverage across all its health insurance plans, ensuring that members receive the best possible care during hospital stays. The coverage includes charges for surgeons, anesthetists, physicians, and consultants. Additionally, it covers hospital accommodation, operating theatre costs, intensive care, and specialist fees. Diagnostic services such as CT, MRI, and PET scans are also included. Members can benefit from comprehensive cancer treatment options, psychiatric treatment for up to 100 days over the membership lifetime, and coverage for home nursing care post-hospital discharge. Emergency medical evacuation and repatriation services ensure that members can receive the necessary care even when local facilities are inadequate.

Out-Patient Coverage

AXA Thailand’s out-patient coverage offers a broad range of medical services designed to support everyday health needs. This includes consultations with general practitioners and specialists, prescribed drugs and dressings, and diagnostic tests like X-rays and ultrasounds. The plans also cover out-patient surgical procedures, vaccinations, and complementary therapies such as physiotherapy and Chinese herbal medicine. Members have access to a virtual doctor service, allowing them to consult with experienced doctors via phone or video. Psychiatric treatment is also available, with coverage for up to 30 sessions. These benefits ensure that members have comprehensive support for both minor and major health issues, enhancing their overall well-being.

For more information, please visit AXA Thailand.

Key Benefits of an AXA Plan

The following services are available to all AXA members.

- Virtual Doctor Service: 24/7 access to medical consultations via video or phone.

- Emergency Medical Evacuation and Repatriation: Ensuring members receive necessary medical care and can be transported to appropriate facilities if required.

- Second Opinion Service: Access to independent medical opinions from highly qualified experts.

- Cancer Support: Dedicated case managers and comprehensive coverage for cancer treatments, including chemotherapy and radiotherapy.

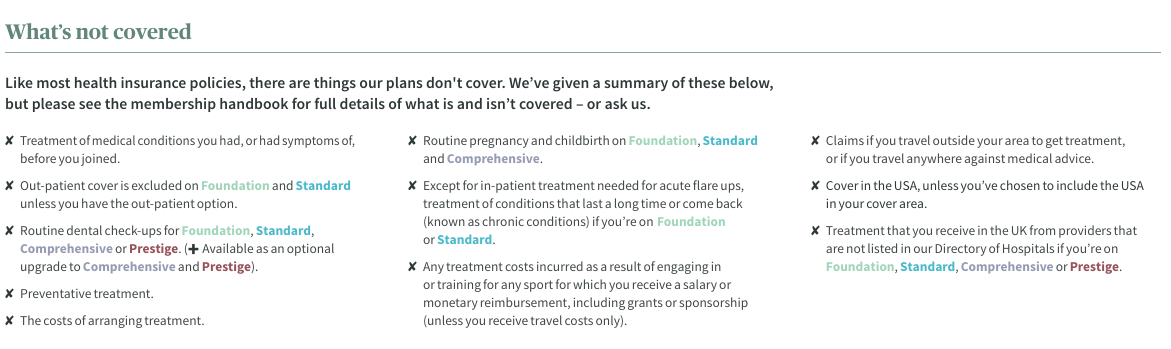

AXA Exclusions

AXA Thailand’s health insurance plans come with certain exclusions. Key exclusions include:

- Pre-existing medical conditions and symptoms that existed before joining.

- Out-patient cover is excluded on Foundation and Standard plans unless the out-patient option is selected.

- Routine dental check-ups and preventative treatments.

- Routine pregnancy and childbirth on Foundation, Standard, and Comprehensive plans.

- Treatment for chronic conditions, except for acute flare-ups on Foundation and Standard plans.

- Any costs related to professional sports activities.

- Treatment outside the covered area or against medical advice, and coverage in the USA unless specifically included in the policy.

For detailed information, refer to the membership handbook or consult with AXA Thailand directly.

AXA Claims

AXA ensures a straightforward and efficient claims process, providing members with timely reimbursements and support. Here’s a detailed overview of how to manage and submit claims with AXA:

Pre-Authorization and Notification

- Planned Treatments: Before any planned in-patient or day-patient treatments, members must contact AXA Thailand to obtain pre-authorization. This step confirms that the treatment is covered under their policy and helps avoid any unexpected costs.

- Emergency Situations: In emergencies, members should contact AXA within 24 hours of hospital admission. Providing membership details and proof of identity at the hospital facilitates immediate assistance and coverage confirmation.

Making a Claim

- Contact AXA: Members should contact AXA before seeing a medical practitioner or undergoing treatment. This ensures that the treatment is covered, preventing members from incurring costs for non-covered services.

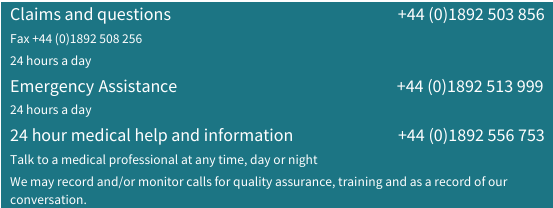

- Claim Submission: Claims can be submitted online through AXA’s customer portal or by calling the claims number. Members need to provide relevant medical documentation, including treatment details and receipts.

- Claims Assessment: AXA will assess the claim, which may involve requesting additional information from the medical practitioner. Prompt submission of requested information helps expedite the claims process.

Payment of Claims

- Direct Payment Arrangements: AXA has direct payment arrangements with a network of hospitals, enabling direct settlement of in-patient and day-patient treatment costs. Members are advised to check if their chosen hospital is within this network to benefit from direct billing.

- Reimbursement: For treatments paid out-of-pocket, members can claim reimbursement by submitting fully receipted invoices. Claims should be made within six months unless circumstances prevent this. The reimbursement is processed based on the exchange rate on the treatment day, ensuring fair and accurate compensation.

AXA Online Portal

Having their own AXA customer online secure login website means that members can:

- Access their policy documents

- Confirm their treatment is covered.

- Make and track claims

AXA has flexible cover to suit you. They offer 4 different levels of cover that come with a choice of add-ons such as out-patient treatment, dental care and routine pregnancy. AXA also provide a unique travel cover add-on which takes into account the medical cover already on the plan, so members avoid paying twice for it.

AXA Useful Info

Second medical opinion service

Our independent second medical opinion service offers a full review of your diagnosis and treatment plan, to make sure you’re doing what’s right for you. Whether you have unanswered questions, or you need some reassurance, it can be invaluable to double check with another medical expert. A doctor will manage the whole process, offering support and answering any questions your your employees may have.

When getting a second opinion, you’ll have access to a global team of more than 450 doctors¹ supported by a network of over 50,000 specialists. All this is available at the end of the phone, from wherever you are – no face-to-face appointments are needed.

How does it work?

When you request a second medical opinion, a doctor will be your main contact throughout your treatment. From beginning to end,

they’ll make sure you get the information you need. It doesn’t mean you’ll always have to choose between two different options – it can often reassure you

that you’re already heading in the right direction.

With clinical case management available with our global health plan, you’ll have support all the way through. If you need treatment after receiving a second opinion, your doctor will continue to support you, offering guidance when you need it most.

Our Advice

If you would like to receive a free quote for this or any of the medical insurance plans, click the link below. One of our health insurance specialists will be happy to assist you.

Got a question that is specific to you? Contact us here.