Understanding the Insurance Policyholder

A health insurance policy is a vital safety net that provides financial coverage for medical expenses. At the core of every health insurance arrangement is the policyholder. But who exactly is the policyholder on a health insurance plan, and what role do they play in this arrangement? The responsibilities of a policyholder and differences from other involved parties like “the insured” often remain unclear. This guide breaks down the intricacies of being a policyholder in health insurance, offering a comprehensive understanding of this key role.

Who is the Policyholder in Health Insurance?

A policyholder is defined as a person who possesses a given health insurance policy. If you purchase a health insurance policy under your own name, this means you are the policyholder for the health insurance policy. You are also covered by all of the benefit details inside.

When you are the policyholder, you have the right to add more people (or commonly as dependents) to your medical insurance policy. The majority of health insurance policies provide coverage for all members of your household who have relationships with you either by blood, marriage or adoption. The policyholder enters into a contract with the insurance provider, agreeing to pay premiums in exchange for the insurer’s commitment to cover certain medical expenses.

Although they are not policyholders of the health insurance policy, they can be covered under the same policy as yourself and therefore can be named insured.

Key Responsibilities of the Policyholder

The role of the policyholder encompasses several important responsibilities. As the individual who establishes the insurance policy, the policyholder is the primary contact for the insurance company. They are responsible for paying the required premiums on time to ensure continuous coverage. Additionally, the policyholder must understand the terms and conditions of the policy, including coverage limits, deductibles, and co-payments. Some additional responsibilities of a policyholder include:

- Paying premiums: The most essential duty is making timely premium payments to maintain coverage. Late or missed payments can lead to coverage cancellation or penalties.

- Choosing coverage: When selecting a health insurance plan, the policyholder plays a crucial role in researching options, comparing benefits, and determining the most suitable coverage for their needs and budget.

- Managing the policy: This includes updating personal information, adding or removing dependents, adjusting coverage levels, and filing claims with the insurance company.

- Understanding the terms and conditions: Familiarizing oneself with the policy details, including deductibles, covered services, and exclusions, is vital to avoid surprises and ensure appropriate utilization of benefits.

- Communicating with the insurance company: The policyholder is the primary point of contact for the insurance company, responsible for inquiries, claim submissions, and addressing any concerns or disputes.

Policy holder on the insurance card

The policyholder‘s name is prominently displayed on the insurance card, serving as a primary point of identification. When a family is covered under a single plan, the policyholder‘s name is typically listed first, followed by the names of covered dependents. This card is presented during medical appointments or procedures to validate coverage and bill the insurer accordingly.

How does the term “policyholder” differ from the word “insured”?

Policyholders are people who own a health insurance policy. They pay the insurance premiums and submit the claims. They have the right to add other people to the policy, so these people are able to get medical coverage as well.

As a policyholder, you need to be mindful of whether the coverage limits are sufficient to cover all the people you would like to add.

However, insureds are people who are covered by the medical insurance policy. The policyholder and their immediate family members who reside in the same household are typically covered as well.

- Policyholder: The individual who owns the insurance policy and manages its aspects like payments, enrollment, and claims.

- Insured: The individual(s) covered by the health insurance plan and eligible to receive medical benefits under the policy terms.

In this case, you are both the policyholder and the insured. In contrast, your family members whom you would like to add to the policy are not the policyholder, but they are also the insureds like yourself.

Filing Claims for the Policyholder

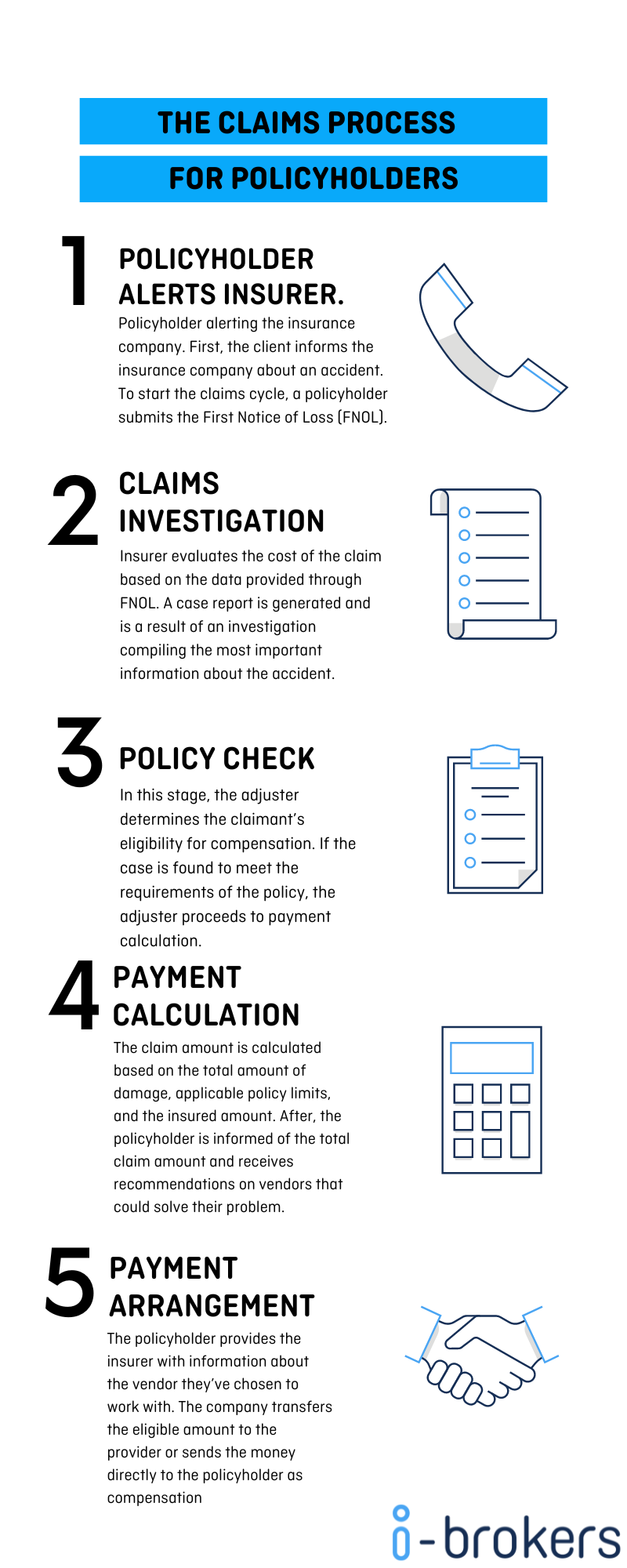

The Claims Process for Policyholders

The Claims Process for Policyholders

Conclusion

In essence, the policyholder is the cornerstone of any health insurance arrangement. They hold the responsibility of initiating and upholding the policy. As the healthcare landscape continues to evolve, it’s imperative for both insurers and policyholders to adapt to these changes, ensuring that the benefits of health insurance are maximized and comprehensively understood by all parties involved.

At i-Brokers, we take great pride in offering the best service to policyholders when it comes to insurance. 82% of consumers who compare insurance with i-Brokers find lower premiums. Can you afford not to? Click here to get a quote on your medical insurance.