In partnership with Luma Health, i-Brokers offers Hi5 and Prime health solutions for individuals and families based in Thailand.

We are delighted to inform you that our insurance partner Luma is introducing a Launch Promotion for all Hi5 and Prime new applications sent to our team between the 13th of September 2022 and the 13th of October 2022.

For each new application sent between the 13th of Sep 2022 to the 13th of Oct 2022, you will receive a Central Voucher valued at 500 THB!

To qualify for this promotion, we require the below documents (which counts as 1 new application):

• Signed application form (1 per application)

This application form can be downloaded here.

• Passport/ID copy of the planholder and any dependents

• Signed PDPA consent form (1 per application)

This consent form can be downloaded here.

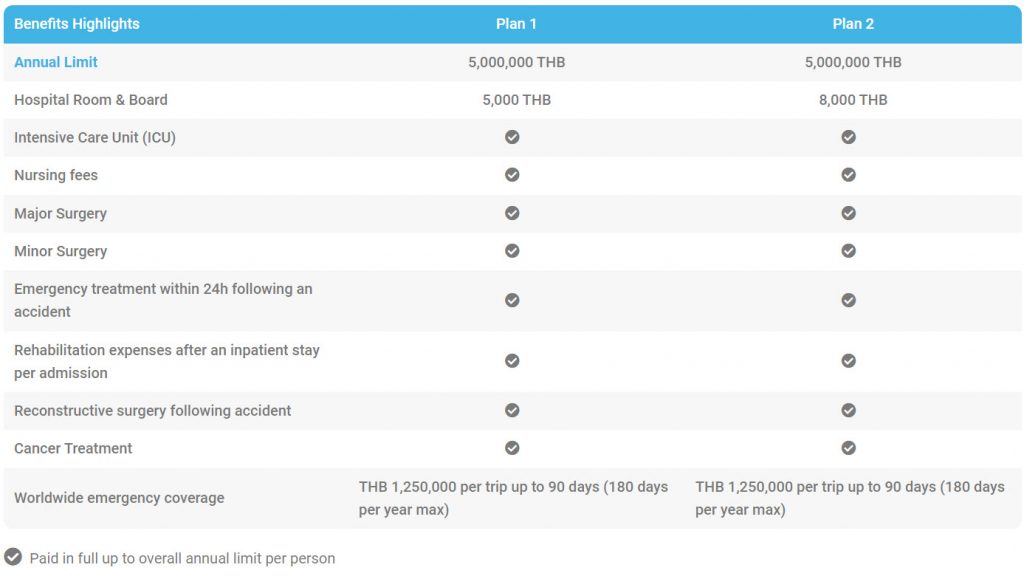

Hi5 Health Insurance

“Hi5” is the marketing name for plans under the Health and Accident Insurance Luma Asia Care Personal Policy insured by Navakij Insurance PCL. It is short for high cover Health Insurance with 5 million THB protection.

Here are 5 key facts about Hi5 Health Insurance plans

1. 5,000,000 THB annual limit with high cover options for Inpatient Hospital Room.

2. They cover COVID-19 and all types of cancer.

3. They provide high cover yet affordable with deductible options to lower down the premium.

4. Guaranteed renewal until 99 years old.

5. They are insured by Navakij Insurance.

Who are eligible for Hi5 Health Insurance?

Residents of Thailand (both Thai citizens and foreigners) for at least 180 days per year who are 0-70 years old are eligible for Hi5 health insurance plans.

Medical professionals, professional athletes, policemen and other high-risk professions (non-exhaustive list) are ineligible for these plans.

Note: Children under 20 years old must apply with at least one parent.

Why are they so popular? Here are some key benefits

If you are interested in seeing the full version of the benefit table, please follow this link.

Table of Premiums of Hi5 Health Insurance

Depending on where you would like to get medical coverage for, you can choose either Zone A, Zone B or Zone C for your Hi5 health insurance plan.

Zone A: worldwide excluding USA

Zone B: worldwide excluding USA, Canada, Switzerland, Israel, Japan, Hong Kong, Bahamas, China

Zone C: worldwide excluding USA, Canada, Switzerland, Israel, Japan, Hong Kong, Bahamas, China, Russia, United Kingdom, Singapore, Taiwan, Brazil

All premiums are in THB, per year, per person

Maximum age to apply 70 years old

Taxes and Stamp Duty are excluded

Policies are issued by Navakij Insurance Company Public Limited

Premiums shown in the PDF file are indicative and may be subject to revision; the age is determined on the actual age upon start date.

Click here to view the full version of the table of premiums.

Hi5 Health Insurance’s Term and Conditions

Here are the terms and conditions for Hi5 health insurance. Make sure you read them carefully before making the final buying decision.

• Elective treatments are covered worldwide except in the following countries: USA, Canada, Switzerland, Israel, Japan, China, Hong Kong, Taiwan, Bahamas, Russia, UK, Singapore, Brazil.

• Pre-existing conditions are not covered.

• All applicants must fill out a medical questionnaire, some additional medical information may be requested.

• Waiting periods apply to certain benefits as per the terms and conditions of the insurance policy.

• Some occupations cannot apply to Hi5 such as (but not limited to): medical professionals, professional athletes, policemen and other high-risk professions.

General exclusions:

(This is a non exhaustive list, please refer to the original Policy Wording for full list of exclusions)

1. Injuries sustained during the commitment of a serious crime or while being arrested or evading capture.

2. Injuries that occur while engaging in motor racing, boat racing, horse racing, ski racing (including Jet skis), skating competition, boxing, parachuting/skydiving, using or racing with a paramotor, gliding, boarding or descending or travelling in a hot air balloon, bungee jumping, diving with air tanks and underwater breathing equipment.

3. War, invasion, acts on foreign enemies, war-like acts whether declared or not, civil war, revolution, insurrection, civil commontion, population rising against the government, riot, strike, coup, declaration of martial law; or any event which led to the declaration or upholding of martial law.

4. Terrorism.

5. Radiation or radioactive transmission from nuclear fuels or from any nuclear waste due to the combustion of nuclear fuel and from any form of nuclear disintegration.

6. Injuries resulting from consequences of being under the influence of drugs or alcohol.

Free look period:

The policy holder has a 15 days free look period (from the day the policy is received) during which they have the right to cancel their policy, in accordance to the terms and conditions of their policy. The paid premium will be returned to the policy holder after deducting any claimed cost under the policy.

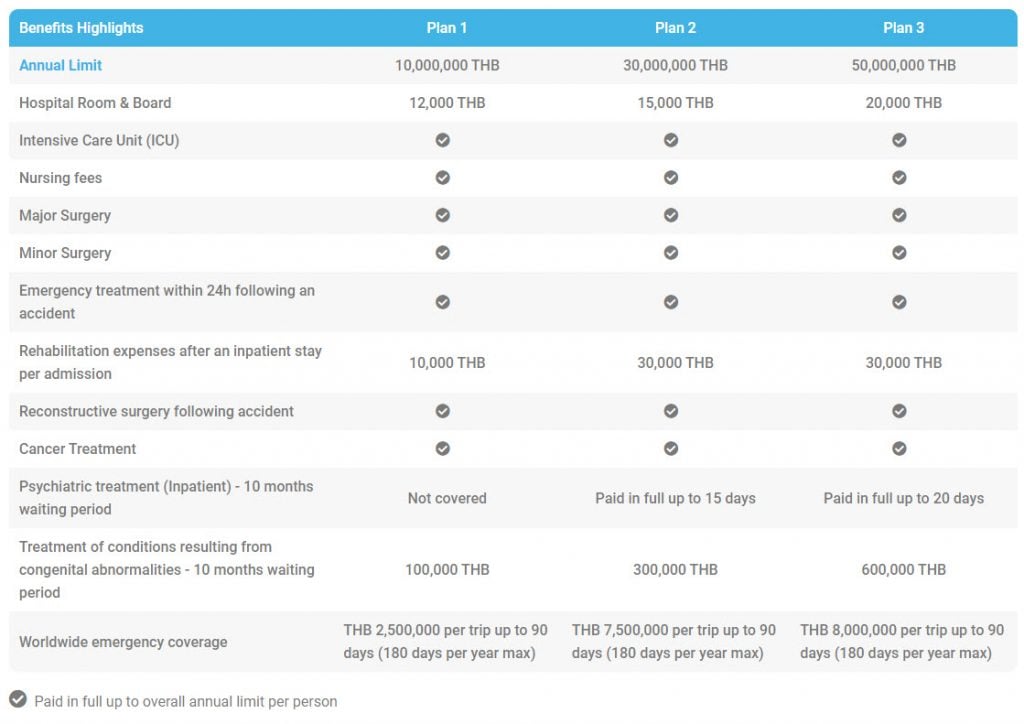

PRIME Health Insurance

PRIME stands for Protection, Renewal, International, Medical and Experienced

Here are 5 key facts about PRIME health insurance

1. Protection

Comprehensive health cover including all types of cancer, Covid-19 and other pandemics.

2. Renewal

Guaranteed renewal until 99 years old.

3. International

Worldwide coverage for planned treatments abroad and emergencies while travelling.

4. Medical

Coverage up to 50m THB per year with high IPD room per day and not limited to Standard Room.

5. Experienced

Insured by Navakij with 89 years of experience in insurance.

Who are eligible for PRIME Health Insurance?

Residents of Thailand (both Thai citizens and foreigners) for at least 180 days per year who are 0-70 years old are eligible for PRIME health insurance plans.

Medical professionals, professional athletes, policemen and other high-risk professions (non-exhaustive list) are ineligible for these plans.

Note: Children under 20 years old must apply with at least one parent.

Why are they so popular? Here are some key benefits

If you are interested in seeing the full version of the benefit table, please follow this link.

International Coverage

For PRIME health insurance plans, you may choose to have your planned treatments in any of the countries listed in your chosen zone.

• Zone A: worldwide excluding USA

• Zone B: worldwide excluding USA, Canada, Switzerland, Israel, Japan, Hong Kong, Bahamas, China

• Zone C: worldwide excluding USA, Canada, Switzerland, Israel, Japan, Hong Kong, Bahamas, China, Russia, United Kingdom, Singapore, Taiwan, Brazil

Essential Worldwide Coverage Included*

* coverage for medical emergencies outside the zone of coverage and according to the terms and conditions of the policy.

• Worldwide coverage in case of accident or unforeseen medical emergencies outside the area of coverage. (up to 90 days per trip, maximum 180 days per policy year)

• International Emergency Medical Assistance (IEMA): Paid in full up to annual limit

Table of Premiums of Prime Health Insurance

Depending on where you would like to get medical coverage for, you can choose either Zone A, Zone B or Zone C for your Prime health insurance plan.

Zone A: worldwide excluding USA

Zone B: worldwide excluding USA, Canada, Switzerland, Israel, Japan, Hong Kong, Bahamas, China

Zone C: worldwide excluding USA, Canada, Switzerland, Israel, Japan, Hong Kong, Bahamas, China, Russia, United Kingdom, Singapore, Taiwan, Brazil

All premiums are in THB, per Year, per Person

Maximum age to apply 70 years old

Taxes and Stamp Duty are excluded

Policies are issued by Navakij Insurance Company Public Limited

Premiums shown in the PDF file are indicative and may be subject to revision; the age is determined on the actual age upon start date.

Click here to view the full version of the table of premiums.

Prime Health Insurance’s Term and Conditions

Here are the terms and conditions for Hi5 health insurance. Make sure you read them carefully before making the final buying decision.

• Elective treatments are covered in the Zone of Coverage to be chosen by the Applicant between:

Zone A: worldwide excluding USA

Zone B: worldwide excluding USA, Canada, Switzerland, Israel, Japan, Hong Kong, Bahamas, China

Zone C: worldwide excluding USA, Canada, Switzerland, Israel, Japan, Hong Kong, Bahamas, China, Russia, United Kingdom, Singapore, Taiwan, Brazil

• Pre-existing conditions are not covered.

• All applicants must fill out a medical questionnaire, some additional medical information may be requested.

• Waiting periods apply to certain benefits as per the terms and conditions of the insurance policy.

• Some occupations cannot apply to Prime such as (but not limited to): medical professionals, professional athletes, policemen and other high-risk professions.

General exclusions:

(This is a non-exhaustive list, please refer to the original Policy Wording for full list of exclusions)

1. Injuries sustained during the commitment of a serious crime or while being arrested or evading capture.

2. Injuries that occur while engaging in motor racing, boat racing, horse racing, ski racing (including Jet skis), skating competition, boxing, parachuting/skydiving, using or racing with a paramotor, gliding, boarding or descending or travelling in a hot air balloon, bungee jumping, diving with air tanks and underwater breathing equipment.

3. War, invasion, acts on foreign enemies, war-like acts whether declared or not, civil war, revolution, insurrection, civil commotion, population rising against the government, riot, strike, coup, declaration of martial law; or any event which led to the declaration or upholding of martial law.

4. Terrorism.

5. Radiation or radioactive transmission from nuclear fuels or from any nuclear waste due to the combustion of nuclear fuel and from any form of nuclear disintegration.

6. Injuries resulting from consequences of being under the influence of drugs or alcohol.

Free look period:

The policy holder has a 15 days free look period (from the day the policy is received) during which they have the right to cancel their policy, in accordance to the terms and conditions of their policy. The paid premium will be returned to the policy holder after deducting any claimed cost under the policy.