What is Expat Medical Insurance?

Expat medical insurance, often referred to as international health insurance or health insurance for expatriates, is a policy designed specifically for individuals living outside their home country. Unlike travel insurance, which covers short-term trips, expat insurance is tailored for those who have made a more permanent move abroad. It ensures that expatriates have access to the best medical care wherever they are, without the worry of exorbitant medical bills.

Get a Quote here.

Why wait? Join 82% of savvy expats who save big by comparing Medical Insurance Premiums with i-Brokers.

Benefits of health insurance in Mauritius.

- Comprehensive Coverage: Health insurance in Mauritius typically covers a wide range of medical services, from hospitalization and surgery to routine check-ups and prescription medications.

- Access to Quality Healthcare: With the right insurance, expats can access top-tier medical facilities and specialists in Mauritius.

- Financial Security: Medical emergencies can be expensive. Having insurance ensures that expats don’t have to bear the brunt of these costs out-of-pocket.

- Peace of Mind: Knowing that you’re covered in case of illness or injury provides a sense of security, allowing expats to fully enjoy their time in Mauritius.

Difference between local and international health insurance.

- Local Health Insurance: This is designed for residents of a specific country. In Mauritius, local health insurance might not cover treatments outside the country and may have limitations on certain services.

- International Health Insurance: Tailored for expatriates, this insurance offers broader coverage, including medical treatments in different countries. It’s ideal for expats who travel frequently or those who want the option of seeking medical care back in their home country.

For instance, an expat from the UK living in Mauritius might opt for international health insurance to ensure they can receive treatment in both Mauritius and the UK.

Medical facilities for expats in Mauritius.

In addition to being renowned for its picturesque landscapes and rich cultural heritage, it is also home to several top-tier medical facilities that cater to both locals and expatriates. Mauritius boasts a mix of public and private healthcare facilities. While public hospitals offer free services, they can be crowded. Private clinics and hospitals, such as the Wellkin Hospital and Clinique Darné, provide top-notch care but come at a higher cost. With the right health insurance, expats can access these private facilities without financial strain. These hospitals are equipped with state-of-the-art technology and are staffed by highly qualified medical professionals. Here are details on five of the best hospitals in Mauritius:

- Wellkin Hospital

- Address: Wellkin Hospital, Royal Road, Moka, Republic of Mauritius

- Contact: +230 605 1000

- Overview: Owned and managed by the company C-Care, Wellkin Hospital is known for providing top-quality healthcare in Mauritius. With departments ranging from cardiology and oncology to psychiatry and urology, it aims to be the most trusted health facility in the country.

- Clinique du Nord

- Address: Baie du Tombeau Rd, Pamplemousse, Mauritius

- Contact: +230 247 2532

- Overview: A reputed health facility in Mauritius, Clinique du Nord treats at least 10,000 people annually. With specialties including cosmetic surgery, neurology, gynecology, and ENT, the hospital prioritizes patient satisfaction.

- Clinique Darne

- Address: Georges Guibert Street, Floreal, Mauritius

- Contact: +230 601 2300

- Overview: Clinique Darne offers a wide range of specialties such as cardiology, gastroenterology, neurology, oncology, orthopedics, endocrinology, gynecology, and pulmonology.

- Victoria Hospital

- Address: Candos, Candos Vacoas Road, Quatre Bornes, Mauritius

- Contact: +230 425 7693

- Overview: Victoria Hospital is one of the primary healthcare providers in Mauritius, offering a range of medical services to the local community.

- Jawaharlal Nehru Hospital

- Address: M2, Rose Belle, Mauritius

- Contact: +230 603 7000

- Overview: Named after the first Prime Minister of India, Jawaharlal Nehru Hospital provides comprehensive medical care to residents and visitors alike.

- Wellkin Hospital

It’s essential for expatriates to familiarize themselves with these medical facilities to ensure they receive the best care possible during their stay in Mauritius. Whether it’s for routine check-ups or emergencies, these hospitals are equipped to provide top-notch medical services.

Do I Need Health Insurance for Expats?

If you want help covering the costs of your medical expenses while living abroad then, yes, you’ll need international health insurance for expats.

For example, Portugal requires expats to carry valid health insurance that covers necessary medical expenses such as urgent care and repatriation.

Cost of medical insurance for expats in Mauritius.

Average annual premiums for expat health insurance in Mauritius range from $1,000 to $2,500 per year for mid-level plans. Couples can expect to pay $2,000 to $5,000 annually.

Factors impacting cost:

- Age – Older applicants pay more

- Coverage level – Plans with more benefits cost more.

- Deductible – Higher deductibles reduce premiums.

- Pre-existing conditions – May increase premiums.

- Use online quotes to compare plans and budget for premiums. Paying a bit more for better coverage is wise. Click here to start comparing insurance plans.

While the country offers both public and private healthcare facilities, the cost associated with each varies significantly. Let’s dive into the healthcare system in Mauritius.

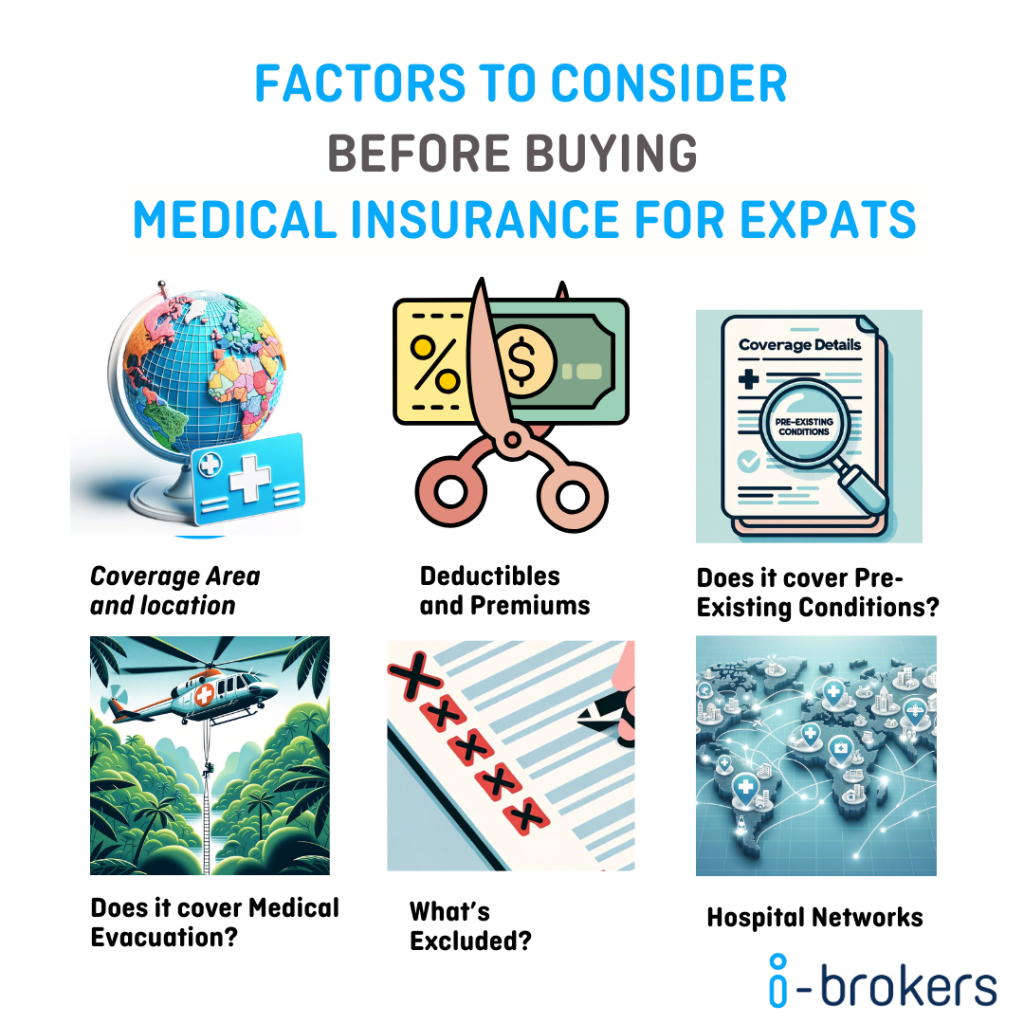

Factors to consider before buying Medical Insurance for Expats

Coverage Area and Location:

This refers to the geographical regions where the insurance policy will be valid. Expats should ensure that the insurance covers medical treatments in the country or countries where they’ll be residing. Additionally, if they plan on traveling to neighboring countries or back to their home country, it’s essential to check if those areas are covered as well. Some policies might offer global coverage, while others might be limited to specific regions or countries.

Deductibles are the amounts that the insured must pay out-of-pocket before the insurance company starts to cover the costs. A higher deductible usually means a lower premium, which is the regular payment made to the insurance company to keep the policy active. Expats should weigh the balance between these two costs, considering how often they expect to need medical care and their financial situation.

Some insurance policies might not cover medical conditions that the insured had before purchasing the policy. If they do cover them, there might be a waiting period before the coverage starts. Expats should ensure they fully understand how their potential policy handles pre-existing conditions, especially if they have any chronic illnesses or ongoing medical needs.

The healthcare system in Mauritius

Public Healthcare in Mauritius:

Mauritius boasts several dispensaries and hospitals in both rural and urban areas that provide public healthcare services. These services are entirely free of charge and available to every resident of the country. However, while public hospitals offer very economical services, they often lack state-of-the-art infrastructure, equipment, or medication. Additionally, these public facilities are known to have extended waiting times.

The healthcare system in Mauritius is undergoing significant transformations to meet the evolving needs of its population. Here’s a comprehensive look:

An Evolving Health Sector: The Mauritian government, recognizing the challenges and demands of the healthcare sector, has initiated the National Health Sector Strategic Plan (HSSP). This ambitious project aims to revamp and improve the healthcare sector by 2030, with a set timeline of five years to achieve its preliminary objectives. The driving factors behind this initiative include:

- The increasing demand for high-quality healthcare and access to a broader range of specializations.

- An aging demographic, naturally leading to heightened healthcare requirements.

- The rising need for treatments of chronic conditions like diabetes and hypertension, which have seen a significant surge in the country.

Price of Local Care: Healthcare costs in Mauritius are categorized based on the complexity of procedures. These are classified as minor, intermediate, major, or major plus. For instance:

- An “intermediate” procedure like a wisdom tooth extraction can cost between 10,000 to 19,000 Rs.

- A “major” procedure such as a cataract operation can range from 25,000 to 50,000 Rs.

Private Healthcare in Mauritius:

The private healthcare sector in Mauritius offers a range of experts and consultation clinics spread across the island. These private healthcare services are equipped with the most sophisticated equipment and provide a high quality of care. Unlike public hospitals, private sector hospitals offer superior quality of treatment but come at a higher price. This difference in cost makes it essential for expats to have a comprehensive health insurance plan that covers all medical expenses. Mauritius also boasts various private care clinics that are well-equipped for regular medication and even some specialties.

Quality of Care in the Public and Private Sectors: Mauritius offers a dichotomy in its healthcare sector with both public and private facilities. The private sector, in particular, boasts of a quality of care that aligns with European standards in most establishments. The medical professionals in the country have received their training from esteemed institutions in Great Britain, France, South Africa, or Russia. Additionally, there’s a significant presence of Indian physicians, further enhancing the diversity and expertise in the medical field.

Mauritius is proactively addressing the challenges in its healthcare sector, ensuring that both its residents and the expatriate community have access to top-notch medical services. Whether it’s routine care or specialized treatments, the island nation is equipped to provide quality healthcare, making it an attractive destination for expatriates from around the world.

Where to Buy Expat Health Insurance in Mauritius?

You can get a quote on a comprehensive expat medical plan directly at www.i-brokers.com/medical – Get a quote in 5 seconds!

Best Health Insurance Providers in Mauritius

For expatriates living in Mauritius, selecting the right international health insurance is crucial for ensuring access to quality healthcare both within the country and abroad. Here are some of the best international health insurance companies for expats in Mauritius:

-

Cigna: Cigna offers comprehensive global health insurance plans with extensive coverage, including inpatient and outpatient care, medical evacuation, and wellness benefits. They are known for their flexible plan options and a wide network of healthcare providers worldwide.

-

AXA: AXA is a leading global insurer offering plans that cover a wide range of medical needs, including preventative care, hospitalization, and specialist consultations. Their plans are known for being highly customizable to suit the needs of expatriates.

-

IMG: International Medical Group (IMG) offers a variety of plans for individuals and families, including coverage for emergency care, routine check-ups, and more. IMG is popular for its affordability and flexibility, making it a good choice for budget-conscious expats.

-

HCI: Healthcare International (HCI) is a renowned provider of international private medical insurance, specializing in comprehensive health coverage for expatriates, digital nomads, seafarers, and other globally mobile individuals. All policy holders are provided a global choice of more than 7,000 medical centres of excellence, and the insurer operates a 24-hour claim line, which members can call from anywhere in the world, 365 days a year, for immediate help and advice.

Get a Quote here.

Why wait? Join 82% of savvy expats who save big by comparing Medical Insurance Premiums with i-Brokers.

Key figures for health insurance in Mauritius

- Number of Expats: Approximately 30,000 expatriates currently reside in Mauritius, contributing to the diverse cultural fabric of the island nation.

- Healthcare Expenditure: The annual healthcare expenditure per capita in Mauritius for expatriates stands at €758.49.

- Insurance Companies: There are 15 insurance companies in Mauritius that offer tailored plans for expatriates.

- Chronic Diseases: Approximately 25% of the expatriate population in Mauritius seeks treatment for long-term diseases such as diabetes and hypertension.

- Private Healthcare Preference: Nearly 80% of expatriates in Mauritius prefer private healthcare facilities due to their high standards and reduced waiting times.

- Maternity Care: About 60% of expatriate births in Mauritius are through cesarean sections, influenced by insurance policies that fully cover cesarean deliveries.

- Health Insurance Premiums: On average, health insurance premiums for expatriates in Mauritius have seen a 5% annual increase over the past five years, reflecting the rising costs of medical care.

- Digital Health Records: With the ongoing eHealth project, approximately 40% of expatriates in Mauritius will have their health records digitized by the end of 2023, ensuring seamless medical care and consultations.

- International Health Insurers: Leading international health insurance providers for expats in Mauritius include Allianz Care, Regency for Expats, and Cigna.

These statistics provide a comprehensive overview of the health insurance landscape for expatriates in Mauritius, emphasizing the importance of adequate coverage and understanding the nuances of the local healthcare system.