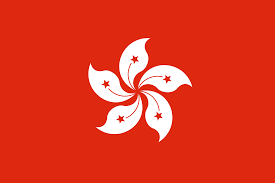

Hong Kong

Expat Insurance Hong Kong

Expat Life in Hong Kong

Hong Kong is a former British colony that was passed over to China in 1997 when Britain’s 99 year lease expired. It is now a special administrative region of China and is still widely regarded as the place where East meets West. With cosmopolitan business districts and vibrant islands, life in Hong Kong is exciting, varied and eye-opening. It’s no wonder around 360,000 expats have settled there. Hong Kong is a major corporate and banking center despite its size. Expats and travelers should research about healthcare in the country before moving to Hong Kong as it recently got voted the most expensive place in the world to live in. This makes the need for expat health insurance in Hong Kong ever more important when residing in the territory.

Medical Insurance in Hong Kong

Health insurance in Hong Kong is an essential investment for anyone living or working in this vibrant city. With the rising cost of healthcare and medical services, having insurance coverage can provide peace of mind and financial protection in case of unexpected medical expenses. Hong Kong is a country whose medical costs are among the highest in the world. In fact, it is second highest in the world only to the USA. As the public medical care system might not be an option for all expats, buying private medical insurance is certainly recommended. Additionally, you might want to supplement your employer-provided insurance plan if it does not cover everything you find necessary.

Hospitals in Hong Kong

While Hong Kong boasts world-class healthcare facilities, navigating the system as an expat can be daunting. Understanding the complexities of public and private healthcare, coupled with choosing the right health insurance, is crucial for ensuring peace of mind during your stay. Hong Kong is home to both public and private hospitals.

Public Hospitals Hong Kong

Public hospitals in Hong Kong are designed for the citizens of the country through its heavily subsidized public health care program. As an expatriate, you will not be seen in a public hospital unless you have a Hong Kong Identity Card. Public health care in Hong Kong is much cheaper than private one. Even though it offers subsidized services to eligible residents, wait times can be long, and specialist care may be limited. As a result, Hong Kong residents utilize it very heavily. Hong Kong’s aging population and large scale migration from China has also added to the bulging workload faced in many of the public facilities. The knock-on effect of this means the public system does suffer from very long waiting times for general treatment as well as for elective medical procedures and are some of the highest in Asia. In fact, the long waiting time for specialist care in Hong Kong has led to approximately 66% of its residents being dissatisfied with public health services.

Although public hospitals in Hong Kong have adequate equipment, some medical personnel also do not speak English. This creates a language barrier for expats, especially those who are not fluent in the native language of Cantonese.

In Hong Kong, there’s usually a small fee charged to users of the Accident and Emergency departments of public hospitals. At the moment this is fixed at $180, and has increased over the years. This is because of the number of people turning up in accident and emergency departments with conditions which are neither the result of an accident nor an emergency.

Private Hospitals Hong Kong

Private hospitals in Hong Kong exist purely for those who opt to purchase private medical insurance in Hong Kong. These facilities are used the vast majority of the time by expatriates. They are a great choice if you need to be seen or treated immediately, want to speak to a medical professional in English (which is not always possible in the public system) and see the best possible consultants and specialists for you and your family.

For visits to see a doctor about a minor ailment or illness, consultations are available at both public and private hospitals. While procedures vary by facility, there are generally no appointments made in the private sector. You can often arrive and be seen instantly. Private outpatient clinics can usually take patients without delay, while the public system has a six-month waiting period for some outpatient clinics. The public system adheres to a strict booking system where at least 24 hours notice must be given before you go to see a GP.

Learn more about healthcare in Hong Kong for expats here.

Pros of Private Health Insurance

- The quality of care and facilities are usually better.

- A wider selection of hospitals to choose from.

- Shorter waiting times.

- More English-speaking staff

With expat private health insurance, you gain the privilege of selecting from a plethora of private healthcare providers as well, tailoring your healthcare experience according to your preferences and needs.i-Brokers provides the experience and knowledge needed to ensure that you find the high-quality coverage you require and have access to the best possible treatment – whenever and wherever it’s necessary.

Travel Insurance Hong Kong

There are a lot of benefits that you can get from having a Hong Kong travel insurance plan but a basic feature of all of these plans is emergency inpatient cover. Essentially this is the backbone of all travel insurance schemes that cover medical care while you are abroad. The coverage for inpatient means that your provider will cover your medical expenses including room and board as well as medicines during your confinement at a hospital. There are other benefits that you can also expect to get from your plan, which benefits vary from insurer to insurer.

Outpatient cover enables you to get reimbursed for medical consultations or minor procedures done in an outpatient setting. This translates to cover for your regular trips to the doctor. If you have a virus or you need a check up or see a specialist then adding outpatient cover often caters this for. This is available with some providers however not all.

As Hong Kong is one of the most expensive places in the world for medical care this is something every traveler should consider when travelling to the territory. Some travel insurance plans already provide this cover while you have to pay extra from the basic plan to get this coverage. Let us guide you to finding the correct plan for your situation and location.

They are many other components that will either come as standard or can be added to your travel insurance policy.

Life Insurance Hong Kong

When you decide you are moving to Hong Kong expat life insurance something that everyone should look at. It is likely that being based in Hong Kong that your liabilities will have increased; living costs are higher with housing and school fees. Would your family have enough provisions to maintain their current lifestyle without today’s household income?

They are a range of life insurance options to consider in Hong Kong. Options available are term life, whole of life and universal life. All these plans work differently and have a range of additional riders that can be added such as critical illness cover, total permanent disability, waiver of premium, income protection and waiver of premium to name a few.

With so many options to consider the task can sometime feel daunting. It is our job to identify what is important to you and find a solution which fits your needs.

No posts found!