Optimum Global

Optimum Global provides comprehensive international medical insurance tailored to the needs of expatriates and families. Their plans offer extensive coverage, emergency medical evacuation, and maternity benefits. With a commitment to exceptional customer support and a global network of healthcare providers, Optimum Global ensures peace of mind for its policyholders worldwide. They combine a reputation for providing a caring, responsive approach to customer care with excellent premiums to match.

About Optimum Global

Optimum Global Health have been providing international medical insurance for expatriates and international travellers alike for over 15 years. They give cover across the world and hold a suite of high-quality medical insurance products that brings together high levels of benefits and service. Optimum Global Health’s wide choice of global health insurance plans are designed to be flexible, allowing you to choose the best cover for you. The ability to make a policy bespoke to your needs and budget is a fantastic proposition that Optimum Global Health offers.

Optimum Global Health have been providing international medical insurance for expatriates and international travellers alike for over 15 years. They give cover across the world and hold a suite of high-quality medical insurance products that brings together high levels of benefits and service. Optimum Global Health’s wide choice of global health insurance plans are designed to be flexible, allowing you to choose the best cover for you. The ability to make a policy bespoke to your needs and budget is a fantastic proposition that Optimum Global Health offers.

Each Optimum Global member has the ability to deal with their own claims specialist straightaway. These people are medical insurance experts and will hold your hand through the entire claims process. This is provided through their specialist claims handler Helix. It is this interaction which has given Optimum Global a reputation for being an industry leader in servicing.

Optimum Global Health helps to make the whole process of getting the very best medical treatment simple, no matter where in the world you may be living or working. An online claims service providing 24/7 claims support and pre-authorization, access to Optimum Global World, their dedicated online global library of carefully selected doctors and medical facilities across more than 175 countries worldwide mean you will take comfort in choosing Optimum Global as your insurance provider.

Optimum Global Health Plans

Optimum Global offers a range of insurance plans tailored to different coverage needs and requirements. Here are the key features of each plan:

Pearl Plan

- Annual Policy Maximum: USD $250,000

- Coverage: Foundation level for in-patient treatment, including pre and post-hospitalization medical expenses, laboratory, x-ray, and diagnostic services. Also includes emergency evacuation and repatriation.

Sapphire Plan

- Annual Policy Maximum: USD $1,000,000

- Coverage: Enhanced in-patient plan with higher policy limits. Includes emergency treatment outside the area of cover, home nursing, hospital cash, maternity complications, and coverage for chronic and congenital conditions.

Ruby Plan

- Annual Policy Maximum: USD $1,500,000

- Coverage: Mid-range plan covering various in-patient treatments and out-patient benefits, including doctor consultations and prescribed drugs.

Jade Plan

- Annual Policy Maximum: USD $3,000,000

- Coverage: Extensive cover for both in-patient and out-patient treatments. Includes vaccinations and a Well-being benefit after 12 months of coverage.

Diamond Plan

- Annual Policy Maximum: USD $6,000,000

- Coverage: Top-level plan providing extensive benefits, with full coverage for major out-patient costs.

Each plan is designed to cater to different levels of healthcare needs, ensuring comprehensive coverage and peace of mind for policyholders.

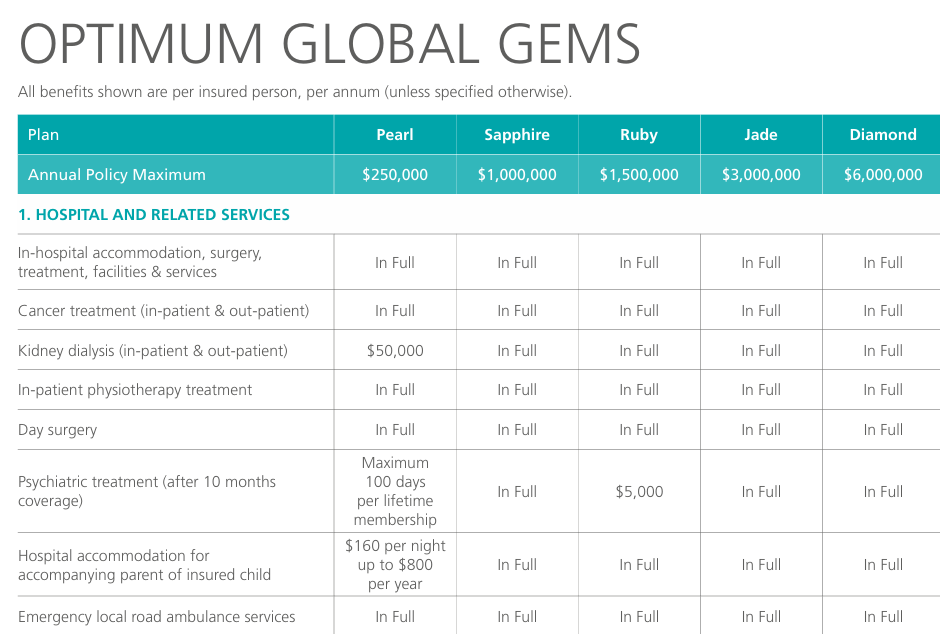

Optimum Global Table of Benefits

Here is the table of Benefits for Optimum Global’s Health Insurance Plans. Coverage Limits for each plan can be seen below 🔽

Key Features and Benefits

Hospital and Related Services:

- Full coverage for in-hospital accommodation, surgery, treatment, and facilities.

- Comprehensive cancer treatment and kidney dialysis.

- In-patient physiotherapy and day surgery.

- Psychiatric treatment after ten months of coverage, with a maximum of 100 days per lifetime membership.

- Home nursing care following discharge from the hospital for up to 26 weeks.

- Emergency local ambulance services and treatment outside the area of cover for up to 45 days per trip.

Pre and Post Hospitalization: Full coverage for pre-hospitalization medical expenses and prescribed post-hospital treatment up to 30 days following discharge.

Organ Transplant: Coverage for the costs of kidney, heart, liver, lung, and bone marrow transplants.

Emergency Medical Evacuation and Repatriation:

- Full coverage for medical evacuation, repatriation, and the repatriation of mortal remains.

- Compassionate travel for family members, including the cost of a return economy class air ticket.

Out-patient Benefits:

- Coverage for family doctor consultations, prescribed drugs, specialist consultations, external prostheses, and diagnostic services.

- Out-patient psychiatric treatment and prescribed physiotherapy.

- Coverage for alternative medicine and emergency room accident and emergency services.

Maternity Benefits

- Comprehensive coverage for delivery, pre and post-natal care, and accommodation for newborns.

- Coverage for complications of maternity and newborn care for the first 30 days.

Dental and Optical Benefits:

- Routine and restorative dental treatments.

- Coverage for eye examinations and glasses every two years.

Claims Process with Optimum Global

Optimum Global aims to provide a seamless claims process for its policyholders, ensuring that they receive the benefits they are entitled to with minimal hassle. Here’s a detailed overview of how to manage and submit claims:

Pre-Authorization and Notification

- Planned Treatments: Before any planned in-patient or daycare treatments, members must contact Optimum Global for pre-authorization. This ensures that the treatment is covered and avoids any unexpected costs.

- Emergency Situations: In emergencies where pre-authorization isn’t possible, members should have someone contact Optimum Global within 24 hours of hospital admission. Providing membership details and proof of identity at the hospital is crucial to facilitate immediate assistance.

- Claim Form: Members must complete a claim form, which is available from Optimum Global’s website or through their adviser.

- Supporting Documents: Submit all relevant medical information, including treatment details and receipts. These documents must be submitted within 90 days of the treatment.

- Submission: Scanned copies of the completed claim form and supporting documents should be emailed to [email protected]. Original documents might be requested if deemed necessary.

Payment of Claims

- Claims are reimbursed based on the currency conversion rate at the time of assessment. While Optimum Global attempts to reimburse in the member’s preferred currency, restrictions might necessitate payments in the policy’s administered currency.

- Optimum Global offers payment guarantees and direct settlements for in-patient claims if adequate advance notice is provided. Out-patient services are typically reimbursed to the member after payment.

Direct Settlements and Approved Hospitals

- Optimum Global has direct billing arrangements with many leading hospitals and physicians. Using non-approved hospitals or physicians will not invalidate a claim, provided the charges are considered reasonable and customary. Optimum Global may adjust benefits payable if charges exceed those of approved hospitals.

Contact Information

For claims assistance, members can reach Optimum Global’s 24-hour support line at +44 (0) 1892 772575 or via email at [email protected]. Click here to make a claim.

Additional Points

- Documentation: Ensure all necessary documentation is complete and accurate to avoid delays.

- Pre-existing Conditions: Claims related to pre-existing conditions might require additional verification.

- Arbitration: Any medical opinion disputes will be settled by medical experts appointed by both parties and, if necessary, an umpire.

By following these guidelines, members can efficiently navigate the claims process, ensuring timely reimbursements and access to necessary medical care. For more detailed information, refer to Optimum Global’s membership guide or contact their support team.

Our Advice

i-Brokers are proud to be working with such an exceptional global health insurance provider, and can offer the full range of Optimum Globa’s Health international medical insurance coverage options.

Free Optimum Global Health Insurance Quotes.

If you would like to receive a free quote for this or any of the medical insurance plans, click the link below. One of our health insurance specialists will be happy to assist you.

Got a question that is specific to you? Contact us here.