Morgan Price

Morgan Price specialize in providing high quality international health insurance plans to expatriates in Hong Kong and throughout the rest of the world.

About Morgan Price

Morgan Price International is a globally recognized provider of international health insurance, known for its commitment to offering flexible, competitive, and comprehensive health insurance solutions. With a strong focus on personalized service, Morgan Price ensures that every client receives a policy tailored to their specific needs, providing peace of mind through reliable and straightforward health insurance products. The company is dedicated to delivering honest and transparent services, treating customers as individuals and ensuring they feel valued and supported.

Morgan Price is an international health insurance company that has been providing expatriates in Hong Kong and all over the world with high quality expat health insurance plans for over 21 years.

Being based in London as Morgan Price London, it also has international offices and does international insurance business in many countries, namely, Morgan Price International Healthcare Dubai (also known as Morgan Price Dubai), Morgan Price International Healthcare Bahrain, Morgan Price South Africa, Morgan Price Kenya, Morgan Price Thailand, just to mention a few examples.

Underwritten by Aria Insurance, Morgan Price International Health Insurance are an insurance provider that offers attractive premiums and benefits. Expatriates throughout the world can use Morgan Price medical insurance policies in any medical facility anywhere in the world thanks to Morgan Price’s solid, global network of medical providers. Insurance plans can be moratorium and have a selection of payment frequencies and methods.

An example of insurance benefit from Morgan Price that is popular with expatriates living in Asia is Morgan Price chiropractor benefit.

Morgan Price Health Insurance Plans

Evolution Plan

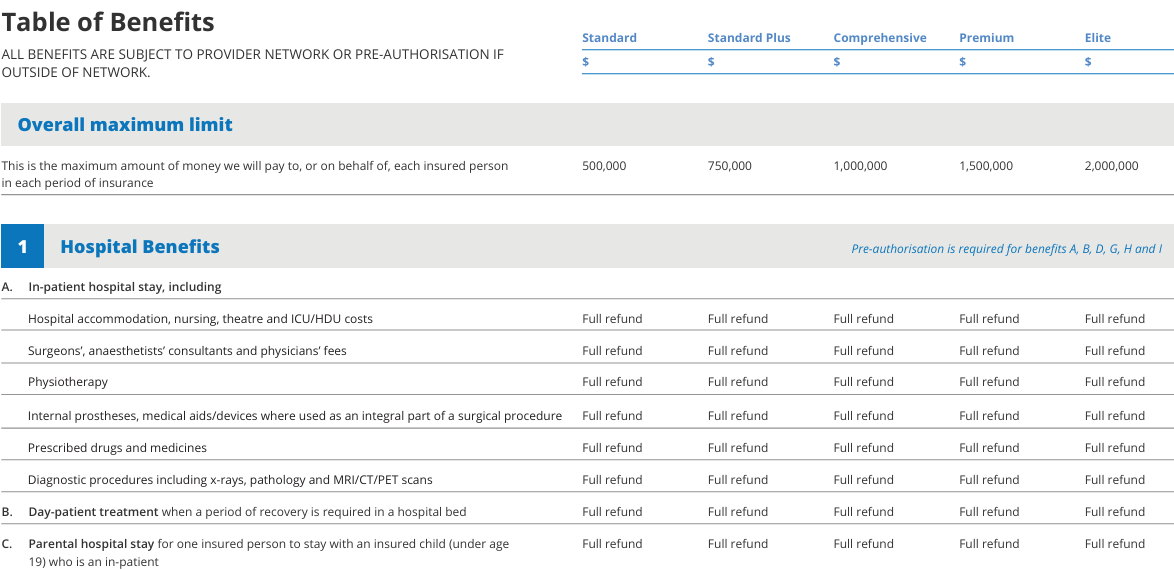

Morgan Price has a great range of plans which are very competitively priced in terms of both benefits and premium. The insurance plan options available are Morgan Price Evolution Standard, Evolution Standard Plus, Evolution Comprehensive, Evolution Premium and Evolution Elite.

Standard Plan: Overall maximum limit: $500,000

Standard Plus Plan: Overall maximum limit: $750,000 (higher than Standard)

Comprehensive Plan: Overall maximum limit: $1,000,000 (higher than Standard Plus)

Premium Plan: Overall maximum limit: $1,500,000 (higher than Comprehensive)

Elite Plan: Overall maximum limit: $2,000,000 (highest among all plans)

Evolution Plan Table of Benefits

Morgan Price Evolution Standard

The Standard plans cover 100% accident and emergency room treatment, rehabilitation care, local ambulance services, in-patient chronic condition benefit, cancer treatment, outpatient minor surgery where no hospitalization is required and hospice care treatment. Aside from these, they provide full cover for emergency dental treatment, emergency medical transportation, companion travel costs, medical assistance costs, repatriation of the deceased and home country evacuation. They have limited outpatient cover.

They do not cover the following benefits:

- In-patient psychiatric treatment

- Kidney dialysis benefit

- Organ implantation benefit

- Day-patient psychiatric cover

- All maternity benefits

- All wellness benefits except USD 50 cover for wellness screening

- All dental treatment benefits except emergency dental treatment

- Companion accommodation costs under the medical evacuation and repatriation benefits

Morgan Price Evolution Standard Plus

Besides what the Standard plans cover, the Standard Plus plans additionally provide expatriates with the following coverage items:

- In-patient psychiatric treatment

- Organ implantation benefit

- Day-patient psychiatric cover

They cover almost all outpatient benefits. The outpatient benefit that they still do not provide medical coverage for hormone replacement therapy, HIV and AIDS treatment.

When it comes to wellness benefits, they still do not cover optical benefit, vision benefit, laser eye benefit, hearing test benefit, hearing aid benefit.

For the coverage of dental treatment benefits, it is exactly the same as the Standard plans.

For maternity benefits, they cover only USD 2,500 for complications of pregnancy and childbirth.

In addition to the Standard plans’ coverage, with the Standard Plus plans, expatriates’ companion accommodation costs are covered at USD 100 with a maximum 10 nights per event for medical evacuation and repatriation benefits.

Morgan Price Evolution Comprehensive

On top of what the Standard Plus plans already cover, the Comprehensive plans further offer HIV and AIDS treatment, laser eye benefit and extraction of wisdom teeth benefit. Notably, the Comprehensive plans’ coverage amount for complications of pregnancy and childbirth quadruples that of the Standard Plus plans.

Morgan Price Evolution Premium

The Premium plans are superior to the Comprehensive plans in terms of higher coverage amount for organ implantation benefit, outpatient benefits, HIV and AID treatment benefit, some wellness benefits, some dental treatment benefits and many maternity benefits. The Premium plans’ amount of cover for out of area treatment benefit is also larger than the Comprehensive plans.

Morgan Price Evolution Elite

The Elite plans’ amount of cover for both inpatient and outpatient benefits are even further higher than the Premium plans. The only benefit that the Premium plans do not provide medical coverage for but the Elite plans do is convalescence cash benefit payable for each complete week of confinement to home.

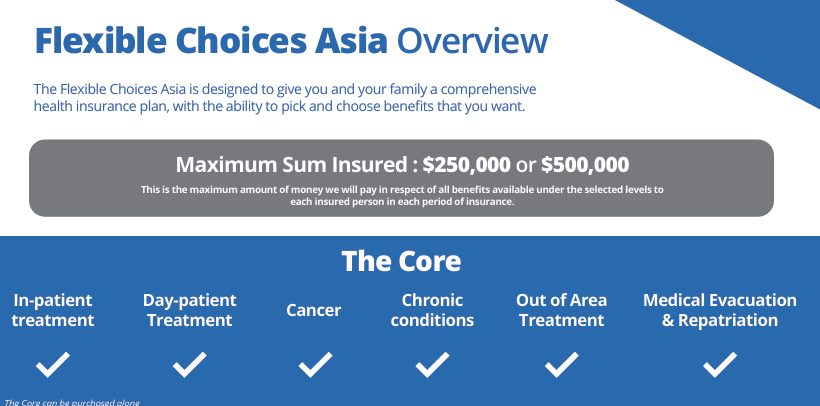

Flexible Choices Plan

Another common plan by Morgan Price is the Flexible Choices Plan. This plan allows policyholders to select additional benefits that best suit their individual or family needs.

Core Coverage

The Flexible Choices product starts with a core coverage plan that includes essential in-patient and day-patient treatments. This core plan ensures that the basic health needs of policyholders are met, providing a solid foundation for comprehensive healthcare coverage. Key features of the core coverage include:

In-patient and Day-patient Treatments:

- Hospital Accommodation: Coverage includes the cost of hospital accommodation in a standard single-bedded room, where available.

- Surgical Fees: Full coverage for surgeons’, anesthetists’, consultants’, and physicians’ fees.

- Diagnostic Tests: Coverage for diagnostic tests such as X-rays, pathology, and advanced imaging (MRI, CT, and PET scans).

- Cancer Treatment: Full coverage for cancer treatments, ensuring that policyholders receive the necessary care without financial burden.

- Emergency Medical Evacuation and Repatriation: Ensures that policyholders can be transported to appropriate medical facilities in case of severe emergencies.

- Transportation of Mortal Remains: Coverage for the transportation of mortal remains, providing peace of mind during difficult times.

- Organ Implantation: Coverage up to $250,000 for organ implantation procedures.

- Accidental Death Benefit: A benefit of $100,000 payable if an insured person dies as a direct result of an accident or injury.

Additional Benefits:

- Rehabilitation: Coverage for rehabilitation following an in-patient admission, up to 30 days.

- Accommodation for Parents Staying with Children: Full coverage for the accommodation costs of parents staying with their hospitalized child.

- Emergency Out of Area Treatment: Coverage of up to $100,000 for emergency medical conditions that occur while traveling outside the insured area.

This flexibility ensures that clients have the coverage they need without paying for unnecessary benefits.

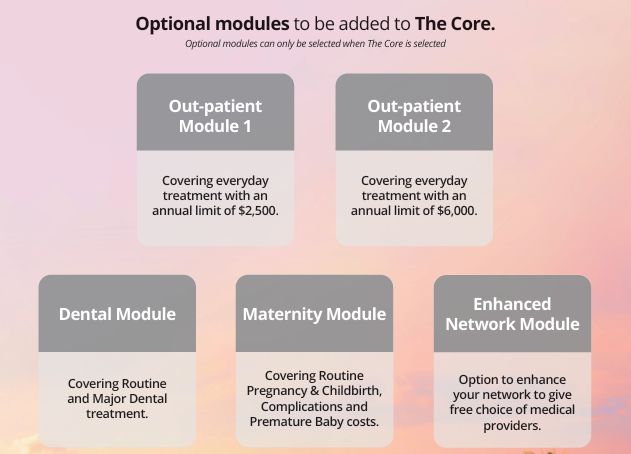

Optional Modules

One of the most attractive features of the Flexible Choices product is its modular structure, allowing policyholders to add optional benefits to their core coverage. This customization ensures that each policy is tailored to meet the specific needs of the individual or family. The optional modules available are:

Out-patient Modules:

- Out-patient Module 1: Provides an annual limit of $2,500 for out-patient treatments, including physician and consultant services, diagnostic tests, and minor surgeries.

- Out-patient Module 2: Offers a higher annual limit of $6,000 for similar out-patient services, providing more extensive coverage.

Dental Module:

- Routine Dental Treatment: Coverage includes routine examinations, cleaning, fillings, extractions, and X-rays.

- Major Dental Treatment: Includes coverage for root canal treatment, new crowns, inlays, bridgework, and repairs to existing dental work.

Maternity Module:

- Routine Pregnancy and Childbirth: Covers pre-natal care, delivery costs, hospital accommodation for the newborn, and post-natal care for the mother. The annual limit is $5,000.

- Complications of Pregnancy and Childbirth: Provides coverage up to $10,000 for complications such as toxaemia, pre-eclampsia, ectopic pregnancy, and medically necessary caesarean sections.

- Premature Baby Cover: Includes costs for medical treatment of a premature baby during the first two months following birth, included in the complications benefit.

Enhanced Network Module:

- Provides access to a broader network of medical providers without incurring a 25% co-insurance for treatments at specified hospitals.

Flexible Choices Coverage Areas

The Flexible Choices product offers three geographical areas of coverage to choose from, ensuring that policyholders can select a region that best suits their lifestyle and travel needs:

- Area 1: Covers Bangladesh, Brunei, Cambodia, East Timor, India, Indonesia, Laos, Malaysia, Myanmar, Pakistan, Papua New Guinea, Philippines, Sri Lanka, Vietnam.

- Area 2: Provides worldwide coverage excluding the USA, Hong Kong, China, and Singapore.

- Area 3: Offers worldwide coverage excluding the USA.

Morgan Price Claims Process

Morgan Price prides itself on a straightforward and efficient claims process, ensuring that policyholders receive their benefits promptly. The process includes:

- Pre-authorization: Required for planned treatments to confirm coverage and prevent unexpected costs.

- Emergency Situations: Contact Morgan Price within 24 hours of hospital admission for assistance.

- Claims Submission: Can be done online through the customer portal or by calling the claims number. Relevant medical documentation and receipts are required.

- Reimbursement: For treatments paid out-of-pocket, claims should be submitted within six months. Reimbursement is processed based on the exchange rate on the treatment day.

Additional Features

- Flexibility in Payments: Policyholders can pay premiums via annual bank transfer or credit/debit card. Installment options include monthly, quarterly, or semi-annual payments.

- Dependents Coverage: Includes coverage for spouses, partners, and dependent children.

- No Maximum Renewable Age: Policies can be renewed without an age limit, ensuring long-term coverage.

- Customizable Excess: Options to apply an annual excess to manage premiums, with various levels available.

Useful Information

On the whole, the Morgan Price Evolution Health allows access to a wide range of quality membership services from Morgan Price. As a Morgan Price Evolution Health member, you will be treated to the following perks:

- 24/7/365 emergency multilingual helpline access

- Automatic membership in the Blood Care Foundation

- Access to state-of-the-art claims processing by Morgan Price’s service partners

Our Advice

If you would like to receive a free quote for this or any of the medical insurance plans, click the link below. One of our health insurance specialists will be happy to assist you.

Got a question that is specific to you? Contact us here.