Healthcare International Group

Healthcare International Group offers a level of support that few international medical insurance providers can match. They combine a reputation for providing a caring, responsive approach to customer care with excellent premiums to match. Explore details about the Insurance Provider below 🔽

About Healthcare International Group (HCI)

Healthcare International Group (HCI Group) is a renowned provider of international private medical insurance, specializing in comprehensive health coverage for expatriates, digital nomads, seafarers, and other globally mobile individuals. With over 20 years of experience in the industry, HCI Group offers tailored insurance solutions to meet the diverse needs of individuals and groups living and working abroad.

They hold a suite of high-quality medical insurance products that brings together high levels of benefits and service. Healthcare International’s wide choice of global health insurance plans are designed to be flexible, allowing you to choose the best cover for you. The ability to make a policy bespoke to your needs and budget is a fantastic proposition that Healthcare International Health offers.

Each Healthcare International member has the ability to deal with their own claims specialist straightaway. These people are medical insurance experts and will hold your hand through the entire claims process. This is provided through their specialist claims handler Helix. It is this interaction which has given Healthcare International a reputation for being an industry leader in servicing.

Healthcare International Health helps to make the whole process of getting the very best medical treatment simple, no matter where in the world you may be living or working. An online claims service providing 24/7 claims support and pre-authorization, access to Healthcare International World, their dedicated online global library of carefully selected doctors and medical facilities across more than 175 countries worldwide mean you will take comfort in choosing Healthcare International as your insurance provider.

HCI Health Insurance Plans

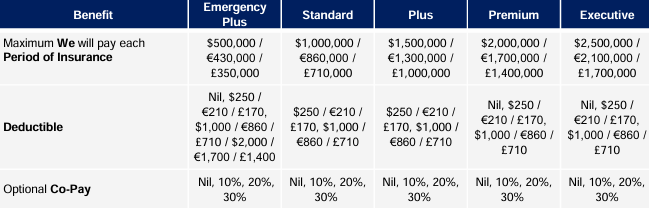

HealthCare International offer five levels of cover, “Emergency Plus”, “Standard”, “Plus”, “Premium”, and “Premier”, providing protection provided anywhere in the world. All policy holders are provided a global choice of more than 7,000 medical centres of excellence, and the insurer operates a 24-hour claim line which members can call from anywhere in the world, 365 days a year, for immediate help and advice.

Their first two levels of cover (Emergency Plus and Standard) provide hospitalization benefits, while the remaining three plans (Plus, Premium and Executive) add increasing levels of out-patient care, preventative healthcare benefits and maternity cover.

Routine dental and Travel insurance are options on all their plans, as is the option to include Term-Life insurance, Disability (Income Protection), Personal Accident, Vision care, and Critical Illness insurance to supplement the health cover.

HealthCare International provides its members options to reduce their premium cost by allowing them to adopt a Co-Payment and / or Deductible on their policy. This can reduce the premium by as much as 60%. Contact us to discuss your premium options.

Health Protect

Health Protect offers affordable health insurance for expats, digital nomads, and the internationally mobile. This plan ensures that clients have access to essential healthcare services, from routine check-ups to emergency medical treatment, without the burden of excessive costs.

- Preventive Care: Coverage for routine health screenings, vaccinations, and wellness check-ups.

- Chronic Disease Management: Support and coverage for managing chronic conditions such as diabetes and hypertension.

- Worldwide Network: Access to a global network of hospitals, doctors, and clinics.

Integra Global

Integra Global focuses on family-friendly health insurance plans for busy professionals and families living overseas. These plans offer extensive benefits, ensuring that families receive the best possible care wherever they are.

- Maternity Care: Comprehensive coverage for prenatal, childbirth, and postnatal care.

- Child Health Services: Specialized coverage for pediatric care, including vaccinations and routine check-ups.

- Mental Health Support: Access to mental health professionals and coverage for therapy and counseling services.

NIMBL Health Plan

The NIMBL Health Plan, introduced by Healthcare International Group (HCI), represents a new era in international private medical insurance, offering unmatched flexibility and comprehensive coverage. Tailored for individuals, couples, families, and employee groups, NIMBL Health empowers clients to take control of their healthcare with a customizable and modular approach.

A word from HCI About their new NIMBL Plan:

“Introducing NIMBL Health – a new, modular, and flexible plan from HCI Group. Our newest product is designed to put clients back in control of their healthcare. NIMBL Health comes with a core set of benefits and an overall cap chosen by the customer. Your customers can then choose to add outpatient cover, routine dental cover, and emergency assistance. Maternity cover is available for group schemes. We know that life’s priorities can change at short notice and that is why we have made it possible to change levels of cover at each renewal. This means your clients will have a policy that can continue to serve them year after year. No hidden limits, no maximum age limit once accepted, and no medical exclusions – even chronic conditions are covered.”

Key Features of the NIMBL Plan

Modular and Flexible Coverage: The plan is modular, allowing clients to choose a core set of benefits and add optional covers such as outpatient care, routine dental cover, and emergency assistance according to their needs.

No Hidden Limits: Transparent policy details with no hidden limits ensure that policyholders know exactly what is covered.

No Maximum Age Limit: There is no upper age limit once accepted into the plan, making it suitable for individuals of all ages.

Coverage for Chronic and Pre-existing Conditions: The plan covers chronic conditions, providing ongoing support and treatment for long-term illnesses.

Worldwide Private Hospital Network: Access to a vast network of private hospitals around the world ensures high-quality medical care wherever you are.

24/7 Emergency Assistance: Round-the-clock emergency medical assistance ensures help is available whenever and wherever it is needed.

Direct Settlement of Inpatient Claims: Inpatient claims are settled directly with the hospital, reducing out-of-pocket expenses and administrative hassle for policyholders.

Comprehensive Cancer Care: All aspects of cancer care, including chemotherapy, radiotherapy, oncology, and related diagnostic tests, are covered whether inpatient, day patient, or outpatient.

Elective Home Country Treatment: Policyholders can opt for elective treatments in their home country, providing flexibility and convenience.

Policy Changes at Renewal: Clients can adjust their levels of coverage at each renewal, ensuring the policy continues to meet their changing healthcare needs.

Simplified Underwriting: The underwriting process is straightforward, making it easier to obtain coverage.

Emergency Medical Evacuation and Assistance: Comprehensive coverage for emergency medical evacuation and associated travel costs, including compassionate travel and repatriation of mortal remains.

The NIMBL Health Plan by HCI Group is more than just an insurance policy; it is a comprehensive healthcare solution designed to adapt to the dynamic needs of modern life. With its flexible, transparent, and comprehensive coverage options, NIMBL Health ensures that clients are always in control of their health and well-being, no matter where life takes them.

HCI NIMBL Plan Table of Benefits for Individuals

| Benefit Category | CORE 1 ($250,000) | CORE 2 ($1,000,000) | CORE 3 ($2,000,000) | CORE 4 ($3,000,000) |

|---|---|---|---|---|

| Total Annual Limit | $250,000 | $1,000,000 | $2,000,000 | $3,000,000 |

| Room and Board | Full Cover | Full Cover | Full Cover | Full Cover |

| Nursing | Full Cover | Full Cover | Full Cover | Full Cover |

| Prescription Drugs and Medicines | Full Cover | Full Cover | Full Cover | Full Cover |

| Physician, Specialist, Surgeon, and Anaesthetist Fees | Full Cover | Full Cover | Full Cover | Full Cover |

| Cancer Treatment | Full Cover | Full Cover | Full Cover | Full Cover |

| Emergency Medical Evacuation | Full Cover | Full Cover | Full Cover | Full Cover |

| Rehabilitation Following Inpatient Treatment | Full Cover | Full Cover | Full Cover | Full Cover |

| Diagnostics (Outpatient) | Covered with Limits | Covered with Limits | Covered with Limits | Full Cover |

| Annual Health Checks (Outpatient) | Covered with Limits | Covered with Limits | Covered with Limits | Full Cover |

| Routine Dental Cover (Optional) | $0 to $3,000 | $0 to $3,000 | $0 to $3,000 | $0 to $3,000 |

This table highlights the key benefits of the NIMBL Health Plan, ensuring extensive coverage for essential healthcare needs for individuals under various coverage tiers, including both inpatient and select outpatient services, as well as optional routine dental cover.

HCI Expat Insurance (Integra Global, Health Protect) Table of Benefits

This table of benefits highlights the coverage and limits across different policy levels, ensuring clarity and transparency for policyholders. The key benefits and their coverage include:

Maximum Coverage Limit: Depending on the selected plan, the maximum coverage limit per period of insurance ranges from $500,000/£350,000 to $2,500,000/£1,700,000. This ensures substantial financial protection against significant medical expenses.

Deductibles: Various deductible options are available, such as nil, $250/£710, $1,000/£710, and others. Policyholders can choose the deductible that best fits their financial planning and risk tolerance, with specific deductible amounts clearly outlined in their insurance schedule.

Co-Pay Options: Optional co-pay percentages include 10%, 20%, and 30%. Policyholders can select a co-pay level that suits their preference, allowing for flexibility in out-of-pocket expenses versus premium costs.

Hospice or Terminal Care Benefits: HCI covers 100% of hospice or terminal care costs up to a lifetime limit of $20,000/£14,000 for basic plans and up to $200,000/£140,000 for premium and executive plans. This includes physical, psychological, social, and spiritual care, as well as hospital or hospice accommodation, nursing care, and prescription drugs.

Emergency and Standard Policies: These policies provide coverage for treatment in an inpatient and day-patient setting only. Higher-tier policies, such as Plus, Premium, and Executive, offer additional coverage and benefits to meet more comprehensive healthcare needs.

Key Features of HCI Health Insurance Plans

1. Global Coverage

HCI Group covers almost anyone living abroad, ensuring that our clients have access to the best private medical facilities worldwide. Our coverage spans across 98% of territories outside the USA, providing extensive healthcare options wherever our clients are.

2. 24/7 Emergency Assistance

We provide global emergency assistance 365 days a year, ensuring that our clients receive prompt medical attention when needed. This service is crucial for individuals living in remote areas or frequently traveling.

3. Competitive Pricing

As a smaller business, HCI Group offers competitive pricing without compromising on the quality of coverage. Our flexible plans are designed to fit various budgets, making high-quality healthcare accessible to a broader audience.

4. Personalized Service

Our expert team is dedicated to finding the best policy for each client’s unique needs. We offer personalized support and guidance throughout the insurance process, ensuring that our clients receive the most suitable coverage.

HCI Customer Reviews

HCI Claims and Support

HCI Group has a streamlined claims process designed to be user-friendly. Claims can be submitted online, and the company offers a dedicated team to assist with claims and ensure quick reimbursement, typically within five to seven days. Please use the following contact information should you need to file a claim or require assistance from Healthcare International Group.

Our Advice

i-Brokers are proud to be working with such an exceptional global health insurance provider, and can offer the full range of Healthcare International Health’s international medical insurance coverage options.

Free Healthcare International Group (HCI) Health Insurance Quotes.

If you would like to receive a free quote for this or any of the medical insurance plans, click the link above. One of our health insurance specialists will be happy to assist you.

Got a question that is specific to you? Contact us here.