Moving to Australia

Moving to Australia offers a high standard of healthcare through a system known as Medicare, which provides access to a range of medical services, from general practitioners to specialists and public hospitals. The system is funded by the government with the help of taxpayers who contribute via the Medicare Levy, set at 2% of their income. Those who have permanent residence status or have Australian citizenship can enroll in Medicare and benefit from free or highly subsidized healthcare.

For those not covered by Medicare or seeking additional services, private health insurance is available. It covers services not fully provided by Medicare, such as dental, optical, and physiotherapy. Private Health Insurance Rebate is a government initiative to encourage Australians to take out private health insurance by offering a rebate on premiums. Navigating the Australian healthcare system as an expat requires understanding both the public and private aspects to ensure comprehensive coverage.

Understanding Health Insurance in Australia

Types of Health Insurance

Health insurance in Australia can be categorized into:

- Public Health Insurance (Medicare): Available to all Australian citizens and permanent residents, which covers part of the costs of public health care services.

- Private Health Insurance: Offering additional coverage, it can be broken down into:

- Hospital Cover: Assistance with hospital costs, with more choice on doctors and shorter waiting times.

- Extras Cover: Provides benefits for services like dental, physiotherapy, and optical.

- Combined Cover: Includes both Hospital and Extras cover for comprehensive health protection.

Eligibility Criteria for Medicare Health Insurance

Eligibility for Medicare typically depends on residency status:

- Permanent visa holders are usually eligible.

- Temporary visa holders may not be, potentially requiring private health insurance as a condition for their visa.

Private health insurance is available to everyone, but choosing the right option depends on individual circumstances, such as visa status, health needs, and whether they fall under a specific exemption category. It’s important for expats to check specific eligibility requirements with the relevant health insurance provider or the Medicare program.

Navigating Health Insurance Choices

In Australia, expatriates must carefully evaluate their health insurance options to determine the most suitable coverage. This involves understanding the fundamental differences between public and private health insurance and knowing how to effectively compare various health insurance plans.

Public vs Private Health Insurance

Public Health Insurance

In Australia, Medicare is the cornerstone of the public health insurance system. It provides all Australian citizens, permanent residents, and some visitors from countries with a reciprocal health care agreement access to free or subsidized medical, optometric, and hospital care. Expatriates holding a permanent visa typically qualify for Medicare.

Private Health Insurance

Aside from Medicare, private health insurance offers additional benefits and covers services not provided by the public system. These may include dental, optical, and physiotherapy services. Various levels of private insurance are available, allowing individuals to tailor their coverage. Those earning over a certain income threshold and without an appropriate level of private hospital cover may be subject to the Medicare Levy Surcharge.

Best Private Hospitals in Australia

1. St Vincent’s Private Hospital Sydney

St Vincent’s Private Hospital Sydney is a world-class medical institution located in the heart of Sydney. It is part of the St Vincent’s Health Australia group, the nation’s largest not-for-profit health and aged care provider. The hospital is known for its excellence in a variety of services including cardiac care, neurosurgery, and orthopedics. With a commitment to providing compassionate and innovative patient care, St Vincent’s Private also has a strong emphasis on research and teaching.

Epworth Healthcare, based in Melbourne, is Victoria’s largest not-for-profit private hospital group. Epworth is renowned for its comprehensive acute medical and surgical services, rehabilitation, and mental health care. The hospital prides itself on its state-of-the-art facilities, including the Epworth Richmond which is one of the most technologically advanced hospitals in Australia. Epworth is also dedicated to clinical education and research with a focus on improving patient outcomes.

3. Mater Hospitals and Health Services

Mater Health Services operates a network of hospitals, health centers, and research institutes in Queensland. Mater Hospitals are known for integrating health, education, and research to deliver a holistic approach to patient care. They offer a range of services including maternity, neurosciences, and cancer care. The Mater also places a strong emphasis on community-based health services, and their research arm is at the forefront of medical research in Australia.

Key components of Medicare Coverage

Key components of Medicare Coverage

- General Practitioner Services

Medicare’s coverage of general practitioner (GP) services ensures that individuals have unhindered access to primary healthcare. This includes consultations with GPs for routine check-ups, preventive care, and the management of common illnesses. Whether it’s a flu vaccination, a health assessment, or ongoing treatment for chronic conditions, Medicare plays a pivotal role in making these services financially accessible to all eligible individuals.

- Hospital Care

One of the fundamental aspects of Medicare is its comprehensive coverage of hospital care. This extends to both inpatient and outpatient services, providing a safety net for individuals facing unforeseen medical circumstances. Whether it’s a scheduled surgery, emergency treatment, or specialized medical procedures, Medicare’s hospital care coverage ensures that the financial burden on individuals is minimized, promoting equal access to essential healthcare services.

Subcategories of Hospital Care Coverage

Inpatient Services

Medicare covers the costs associated with being admitted to a hospital as an inpatient. This includes accommodation, medical procedures, and necessary medications during the hospital stay.

Outpatient Services

For medical procedures and treatments that don’t require an overnight stay, Medicare’s coverage extends to outpatient services. This ensures that individuals receive necessary medical care without being burdened by exorbitant costs.

Pharmaceutical Benefits Scheme (PBS)

Integrated seamlessly with Medicare, the Pharmaceutical Benefits Scheme (PBS) is a crucial component of healthcare coverage in Australia. The PBS subsidizes the cost of prescription medications, making essential drugs more affordable for individuals. This not only promotes adherence to prescribed treatments but also ensures that the financial aspect of obtaining necessary medications is not a barrier to health.

Key Aspects of PBS Coverage

- Medication Subsidies

Under the PBS, individuals receive substantial subsidies on a wide range of prescription medications. This makes essential drugs more accessible and affordable, contributing to the overall well-being of the population.

- b. Prescription Safety Net

To further alleviate costs, the PBS incorporates a Prescription Safety Net. Once an individual reaches a certain expenditure threshold on medications within a calendar year, additional prescriptions are dispensed at a lower cost or, in some cases, free of charge.

In essence, Medicare’s coverage of pharmaceuticals through the PBS ensures that individuals can access and afford the medications vital to their health, promoting a healthier and more economically equitable society.

How to Compare Health Insurance Plans

Expatriates should consider the following when comparing health insurance plans:

- Coverage: Ascertain which medical services and treatments are covered. Check if the plan includes services you deem necessary, such as dental, optical, or overseas coverage.

- Cost: Assess the premium, deductibles, co-payments, and out-of-pocket maximums. Remember to factor in the Private Health Insurance Rebate, a government-funded incentive that reduces premiums.

- Limitations and Exclusions: Understand any restrictions or services that are excluded from the health insurance policy.

- Waiting Periods: Be aware of the duration before you can claim benefits for certain treatments.

- Preferred Providers: Some plans have agreements with certain doctors, specialists, or hospitals, providing better rates when using preferred providers.

- Portability: Consider if the plan is transferable or has benefits that apply if you travel or move out of the country.

Selecting the right health insurance in Australia requires balancing the need for comprehensive coverage with the costs of premiums and potential tax implications. Expatriates should carefully compare plans to find a suitable match for their healthcare needs and financial situation. Compare health insurance here.

Health Insurance Comparison Tips

To effectively compare health insurance plans, follow these steps:

- List Your Priorities: Identify your essential healthcare needs.

- Compare Coverage: Scrutinize what each plan covers and doesn’t cover.

- Evaluate Costs: Consider all financial aspects, including premiums and potential out-of-pocket expenses.

- Check Provider Networks: If you have preferred doctors or hospitals, ensure they are covered by the plan.

- Consider Flexibility: Assess how well the plan adapts to changes in your location or circumstances.

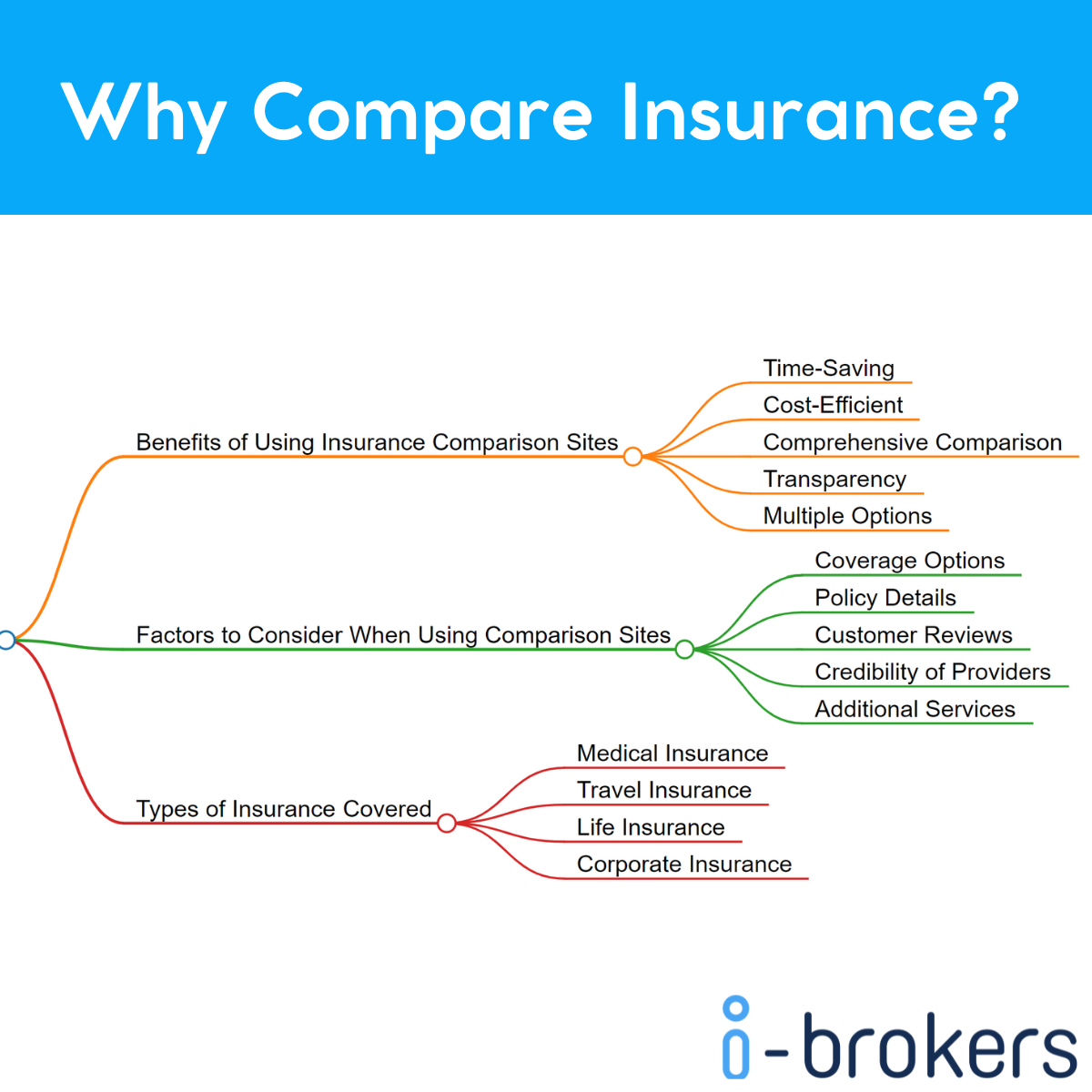

Why Compare Insurance?

Enrollment and Use of Health Insurance

When moving to Australia, understanding the enrollment process and effective utilization of health insurance is crucial for expats. This ensures not just compliance with visa requirements but also guarantees peace of mind regarding healthcare needs.

Step-by-Step Enrollment Process

- Eligibility Check: Expats should first ascertain their eligibility for the Medicare system or need for private health insurance, depending on their visa type. It’s generally a good idea to have both.

- Research and Compare: It’s essential to compare different health insurance plans, focusing on coverage, premium costs, and exclusions.

- Application Submission: After selecting a suitable plan, expats must complete and submit an application form, providing necessary personal and visa details.

- Await Approval: The insurer will review the application and, if acceptable, provide policy documents and membership details.

- Policy Activation: Upon payment of the initial premium, the health insurance policy is activated, and the expat can access medical services as covered.

Making the Most of Your Health Insurance

- Understand Your Policy: Familiarize oneself with the policy’s benefits, limits, and waiting periods for certain treatments.

- Preventive Healthcare: Utilize preventive services offered, like vaccinations and screenings, which can improve health and potentially lower overall costs.

- Network Providers: Make use of the insurance’s network of providers to minimize out-of-pocket costs.

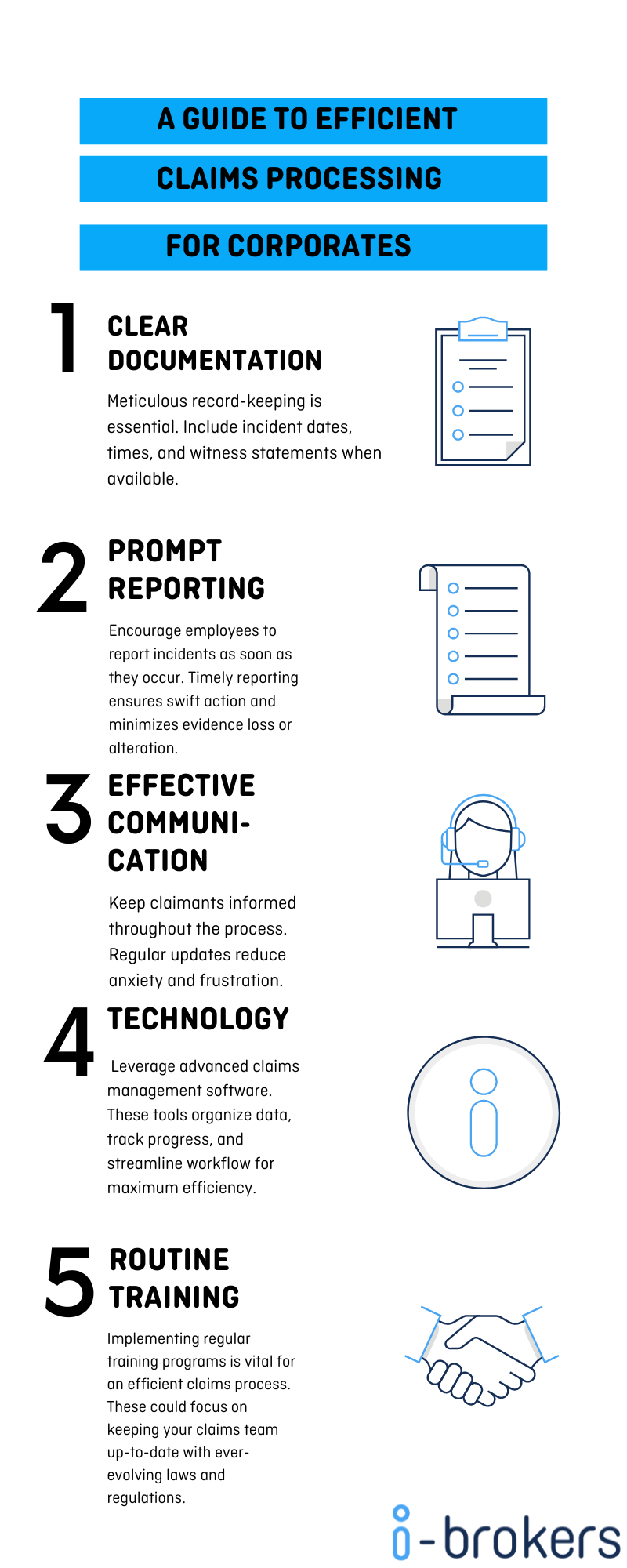

Handling Claims and Reimbursements

- Immediate Notification: Notify the insurer as soon as possible after receiving medical treatment which is claimable.

- Document Submission: Submit all required documents, such as detailed bills and medical reports, to the insurer.

- Follow Up: Track the claim’s progress and be prepared to provide additional information if needed for the reimbursement to be processed.

Our Advice

It is always important to learn about healthcare system in each country, where the best hospitals are, and also how much their insurance works.

At i-Brokers, we take great pride in offering the best service possible when it comes to insurance. 82% of people who compare insurance with i-Brokers find lower premiums. Can you afford not to? Click here to get a quote on your medical insurance. Choose a customized insurance plan, tailored to suits your budget, requirements and needs of your loved ones.